Sheep stock clubs

Contents:

- What is a Sheep Stock Club?

- Common Grazings & Land Tenure

- Subsidies and Other Grant Support

- Liability

- Legal Structures

- Choosing a Legal Structure

- Types of Legal Structures

- Unincorporated Association

- Companies Limited by Shares

- Registered Co-operative

- Choosing an Appropriate Legal Structure

- Members’ Agreement & Operating Procedures

- Drawing up a Members’ Agreement

- Taxing issues

- Succession

- The FAS Sheepstock Club Review Guide

Sheep stock clubs have a long heritage in the Highlands and Islands with many established after the First World War when a number of crofting townships were first formed. Sheep stock clubs can broadly be defined as sheep flocks held in common ownership on a defined area of land and farmed for collective benefit. Whilst most are primarily concerned with sheep farming some do have a limited number of cattle.

More commonly sheep stock clubs are based in a crofting township where some or all of the crofters have a share in the sheep stock club. The sheep are farmed collectively on the common grazing and the returns from sales, after the deduction of costs and reserves, are split equally amongst the shareholders in the club.

Historically, rights in a sheep stock club were generally linked to the crofter’s share of the common grazings in a crofting township. When the sheep stock club was set up, each croft was allocated a share in the flock. Accordingly each crofter’s interest in the sheep stock club was dependent on and indivisible from his/her share in the common grazing. In essence the flock was seen as an indivisible whole with no shareholder permitted to keep private sheep on the common grazings.

Given that permission to run a sheep stock club on a common grazings was done under the auspices of the Crofting Regulations pertaining at the time, many of the rights and obligations of the sheep stock clubs are specified under the individual common grazings regulations. In other words, general guidance often existed concerning the sheep stock club itself but less so with respect to operational procedures and individual members’ rights and obligations. These tended to be agreed at a local level and many have changed considerably over time.

Notwithstanding, sheep stock clubs have stood the test of time in so far as many of them are still in operation and making a valued economic contribution to crofting. However, the passage of time has seen many of the original co-operative rules lapse and many of the farming practices change and the Crofting Foundation report highlighted a number of legal and operational issues that required to be brought up to date.

>Common Grazings & Land Tenure

Sheep stock clubs are generally granted sole rights to keep sheep on the common grazings as defined in the individual Common Grazings Regulations in terms of Section 47(8) of the Crofters (Scotland) Act 1993. Where these are approved by the Crofting Commission the township is deemed to be “in office”. Where common grazings are “out of office” or of other status, the sheep stock club should hold a lease or other legal agreement to have the right to keep sheep in the common grazings.

It is to be noted that no shareholder can hold sheep on the common grazing where a sheep stock club holds sole rights. Where a sheep stock club has the sole rights to hold sheep on the common grazings, the regulations will define the terms and conditions under which the sheep can be held and managed. This, however, does not apply to cattle. It is also important to note that, whilst it may have a close working relationship with one or more common grazings, the sheep stock club is a separate legal entity. For the avoidance of doubt, it is to be noted that the Crofters (Scotland) Act 1993 legislation supersedes the rules of any sheep stock club.

However, it should be noted that the sheep stock club model and other co-ownership models of livestock production need not necessarily be restricted to common grazings. It is through history and common need that most sheep stock clubs operate on the crofting common grazings but they could operate equally on any other area of suitable land under a separate legal agreement.

In any review of a sheep stock club operating on the common grazings, it is important to consider the best legal structure that both meets the requirements of the Crofters (Scotland) Act 1993 and the needs of the crofter members.

>Subsidies and Other Grant Support

Where a sheep stock club operates with all necessary permissions and agreements it is entitled to register, where eligible, in its own right for any Scottish Government subsidy entitlement and/or additional grant support. The level of support received will generally be based on the sheep stock club’s scale, structure and operational activities. Applying for and administering Scottish Government grant support may well require external professional advice.

For further information please refer to our page on CAGS grants

The members of sheep stock clubs that operate as associations or other unincorporated entities are all jointly and severally liable for the liabilities of the organisation. In other words, they can be pursued individually for the debts of the organisation. In those clubs which are incorporated either as co-operatives or companies, the individual member’s liability is limited to the value of his/her shareholding. Regardless of its legal structure the sheep stock club still carries a duty of care to third parties and its employees in the course of its operations. It is to be noted that both paid workers and unpaid volunteers are considered as employees in this respect. All sheep stock clubs are therefore advised to take professional advice with respect to employee, public and product liability to cover their operations.

For further information please refer to this guidance from NFU Mutual

Given that many sheep stock clubs have been in existence for a long time, a considerable variation in local arrangements exist to suit individual circumstances. Where such informal arrangements now exist and where these are not written down, matters may be taken forward by consensus and agreement. However, in the event of any disagreement or legal action arising it is often extremely difficult and costly to resolve such disputes.

Sheep stock clubs should therefore give careful consideration to formalising their operations in writing at some point to help reduce the risk of disagreements or legal actions arising in the future.

It is good practice for all sheep stock clubs to periodically review their membership, structure and operation to ensure both legal compliance and optimal economic benefit to members.

The legal structure under which individual groups run is largely influenced by a number of factors –

- How the club was historically constituted or incorporated

- The number and proximity of the existing members

- The size of the flock and the area of common grazing

- The availability of labour from both within and out with the group

- The policy of the group regarding new entrants and retiring members

- The ambition of the group with respect to growth, profitability, environmental improvement and other related commercial activities.

Sheep stock clubs can operate under a number of possible legal structures. These can include -

- Unincorporated group (with or without a written constitution)

- Company Limited by Shares

- Registered Co-operative

Where a formal legal structure is chosen by a sheep stock club it is considered prudent to also give consideration to –

- Member’s Agreement (Contract between the member and the organisation)

- Operating Procedures (How the organisation operates at an operational level)

Both of the above are often amalgamated into one document. Clearly it is more practical for smaller sheep stock clubs to formalise their arrangements into one document to define how they deal with the various issues of authority and operation required to run the organisation effectively and efficiently.

The member’s agreement specifies what the member should expect from the organisation and what the organisation expects from the member. It is in essence a contract between the member and the organisation.

Operating procedures should define the day to day workings of the organisation and may be changed by the Board of Directors or Committee as and when required without reference to the wider membership.

In essence there are two approaches that can be taken with respect to the above. The overarching legal structure can be modified to encompass the specific requirements of a sheep stock club or the overarching document can state a requirement for all members to be party to a member’s agreement.

The advantage of the former means that the legal structure is tailored to suit the exact needs of the sheep stock club. The disadvantages are that to have standard company memo and articles or co-operative rules adapted to suit the sheep stock club model could be quite expensive and secondly any changes or local variation that arise must go through due process and be registered as changes with the relevant authority.

The latter addresses these issues by using relatively standard company or co-operative models that state that in order to be a member of the sheep stock club all members must be party to a current members’ agreement. The members’ agreement is a locally produced contract between the sheep stock club and the member which can be changed at a local level.

The following describes three of the main organisational types. Other organisational models such as Companies Limited by Guarantee, Community Interest Companies, Limited Liability Partnerships and various co-operative models are described elsewhere.

Many sheep stock clubs operate as unincorporated groups either with or without a written constitution. Constitutions, where they exist, tend to follow a standard format with respect to membership and governance. These tend to be found in smaller townships where the principals are all known to each other and operate largely on custom and practice. The club holds the sheep in common ownership for the members and the members decide how the flock is managed. The management of the flock on the common grazing can be done by all or some of the members either on a paid or voluntary basis. Some sheep stock clubs employ dedicated shepherding staff and others use outside contractors.

As an unincorporated group all members are jointly and severally liable for all debts and liabilities of the club. The decision as to whether to incorporate tends to depend on the level of risk and liability to which the group is exposed. Some smaller groups prefer the relative freedom and low cost operation of the unincorporated model. Some seek to offset some of the risk by taking out employers and public liability insurance

Unincorporated groups are required to be registered with HMRC with respect to tax and VAT where these are applicable. Some groups however seek to minimise the tax liability of the group by returning dividends to the members thereby reducing the tax position of the group.

Most sheep stock clubs are set up on the basis that certain defined crofts in the township are the sole members i.e. they are automatically or historically members and no other outside party may become a member of the club. In these circumstances, the membership is restricted and entry to the club only possible by the purchase of an eligible croft or an existing member’s entitlement.

In many unincorporated sheep stock clubs it is often not clear as to the exact legal position with respect to sale or transfer of an existing member’s shareholding. This often takes place by private arrangement between members but it would be recommended that legal advice be taken to establish and confirm the legal ownership position before entering into any form of sale/purchase contract.

As above, a sheep stock club might decide on whether to incorporate as a Company Limited by Shares registered with Companies House dependent on the risk and exposure to which the members are exposed. The primary purpose of a limited company is to derive dividend and/or capital value for the shareholders. In a limited company the member’s agreement is often referred to as a shareholder’s agreement. The primary advantage of the limited company is that the shareholder’s liability is limited to the value of their shareholding. In other words their liability is limited to the value of their investment in the company. Where allowed for in the Memorandum and Articles of Association, the advantage of the limited company would be that shares could be traded to allow new entrants to buy a share in the company and exiting members sell. It could however allow any individual shareholder to acquire additional shares and consequently the additional voting rights arising therefrom. On this basis one or more individuals could assume a greater controlling interest in the company which, on one hand might provide a stimulus to growth and activity, but on the other might not be seen as fair and equitable across the wider crofting community. Consideration would have to be given as to how the member’s share in the common grazing and his/her share in the sheep stock club could be accommodated under the current crofting legislation and local common grazing regulations that apply. Similarly the standard Memorandum and Articles of Association would have to be reviewed with respect to how the shareholders wanted the company to be structured and run. Developing a company based sheep stock club model would require specialist legal and crofting advice to make sure that in addition to providing additional benefit and protection to members, it met all company and crofting legislation.

A co-operative register by the Financial Conduct Authority carries the same level of limited liability as a limited company. The primary difference is that the co-operative exists for member benefit and not for dividend on profits and/or capital gain. Co-operatives are generally structured around member economic participation - the greater use the member makes of the co-operative the greater return they will receive in terms of trading bonuses and on dissolution. Shares in a co-operative remain at par and, dependent on the rules, may or may not be withdrawable or transferrable. In other words a member may join the co-operative and benefit from its trading activities but on leaving is only entitled to the value of his/her shares (if allowed for in the rules) and not an apportionment of the capital value of the business. In order to address this issue, marketing co-operatives may set up what are termed “qualification loans”. These are loans in the member’s name which are generally repayable within five years of leaving. The individual qualification loans may be built from a pro rata allocation of profits from the co-operative’s trading activities. The advantage of this is that the member gets some degree of financial return for their participation in the co-operative. The disadvantage is that the member is eligible for tax when the money, which remains in the co-operative, is allocated to his/her account. Another option is to have shadow accounts set up within the co-operative which defines an allocation from reserves to which a member is entitled to on leaving. The advantage of this is that tax on allocations received only becomes due on exit. However the monies only become due to the member on exit and therefore are not considered in the interim as loans.

The co-operative model suits the situation where the sheep stock club exists for fair and equitable return to members. As allowed for in the rules of the co-operative and approved by the Board of Directors, membership of the co-operative may be transferred at terms and conditions agreed between the new and retiring member. Notwithstanding it is important to note that membership of the co-operative does not entitle the shareholder to an equal share of the capital value of the co-operative on exit. In this respect the co-operative structure best fits a situation where there are a number of members of similar size and ambition and there is a notion of long term operation. It does not lend itself particularly well to exit of existing and entry of new members.

For further information please refer to "Sheep Stock Clubs possible business structure" document produced by Campbell Stewart MacLennan & Co.

>Choosing an Appropriate Legal Structure

The first point of note is that to date all the sheep stock clubs that have been contacted in the course of our work operate largely on a historical basis on the common grazings. Whilst this gives them defined sole rights to hold sheep on the common grazing, it also requires them to accept into membership any crofter in the township that has a right in the sheep stock club. In essence this means that size of the membership is largely fixed. It also means that those inactive crofters who hold a share in the sheep stock club can benefit from dividend although they might not be actively working the croft of the common grazing.

Work on the flock can be undertaken by members of the club either on a paid or voluntary basis. In practice, however, this can be problematic as some members do not want, do not have the skills or are not physically able to help. This leaves the work to an increasingly small number of active crofters. In many cases the work is carried out by employed labour or outside contractors. The original post First World War co-operative concept of everybody in the club working on the sheep is now very rare. More commonly today, with a marked reduction in the number of people available, there is an increasing specialisation of labour leading to some people questioning the dividend being returned to the inactive sheep stock club members. In this respect many sheep stock clubs can be seen primarily as investment vehicles which return an annual dividend to crofters that have an entitled membership club but who do not participate or indeed may not live in the area.

It would be recommended that existing and any new groups should give initial consideration as to who will own, operate and benefit from a sheep stock club. Many sheep stock clubs which historically were set up on the basis of every croft having a right in the sheep stock club would have to take specialist advice if it were to consider changing its structure. In essence this would require consideration of the historic and current legal structure of the club, the common grazing regulations applying and the overarching crofting legislation.

It is clear from the consultation undertaken with various sheep stock clubs that there is no “one size fits all” model. Each group must be considered on its own merits and a model designed to suit the scale, composition and ambition of the group. The original notion of every croft in the township being in the sheep stock club could be seen as a limiting factor with respect to any individual or small group of crofters who wish to grow and invest in sheep and the necessary fencing and facilities on the common grazing.

>Members’ Agreement & Operating Procedures

A members’ agreement is essentially a secondary contract between the member and the organisation. There are other terms sometimes used such as secondary or subsidiary rules. The purpose of the members’ agreement is to clearly define what the organisation expects of the member and what the member should expect of the organisation. The purpose of members’ agreements is also to save the organisation having to change its co-operative rules or memorandum and articles with the Financial Conduct Authority or Companies House. Where a members’ agreement exists the rules or memorandum and articles should state that membership of the organisation requires all members’ to be party to a current members’ agreement where one exists. In other words being party to a members’ agreement is a condition of membership. Most members’ agreements require ~75% of the membership to vote in favour of any change to the agreement and any party not willing or able to do so after a period of normally three months will cease to be party to a members’ agreement and consequently will cease to be a member of the organisation.

Historically members’ agreements were written largely in more legalistic terms which had the benefit of being more robust in legal terms but which were in many cases not readily understood by the lay person. There has been a move over the last number of years for co-operatives particularly to make members’ agreements shorter and to be written in plain English. It has to be noted however that care should be taken to make sure that members’ agreements are clear, concise and not ambiguous in their interpretation.

>Drawing up a Members’ Agreement

In writing a members’ agreement it is important for sheep stock clubs to consider what it is that the organisation seeks to achieve that provides maximum benefit to the membership with minimal risk. It is important to consult widely within and out with the membership to ensure that all pertinent factors that affect the members’ agreement are allowed for. It is important to engage professional support to ensure that the final document is fit for purpose and legally founded before presenting it to the membership for approval.

Members’ agreements can vary widely dependent on the nature and operation of the organisation. However with most sheep stock clubs the basic model and method of operation are fairly similar with minor local variations.

Whilst the members’ agreement defines the contractual relationship between the member and the sheep stock club, the operating rules define the day to day operations of the organisation. It is important that the committee or Board of Directors can manage operations without need to continually refer to the wider membership.

Members’ agreement might contain some or all of the following -

- The name of the party to the members’ agreement – it is important to define if the member is an individual, partnership, limited company that has rights in the common grazing and therefore a share in the sheep stock club or otherwise as approved by the Grazings Committee and/or the Crofting Commission.

- Definitions & Interpretations – in order to negate any degree of lack of clarity or ambiguity, it is necessary to list all relevant legislation, rules and regulations, areas, livestock, committed time or financial contribution, managing arrangements, operating procedures, and any other term(s) referred to within the agreement.

- Common Grazing Regulations – where these are specific to, or under general application, the common grazings regulations supersede the rules of the sheep stock club and all members should be aware of their rights and obligations under the regulations applying. It is important to consider how the souming is allocated by the grazings committee and the limits on the size of the flock.

- The Role and Powers of the Committee / Board of Directors - the composing and the powers of the Committee/ Board of Directors should be clearly stated with respect to the governance and operation of the sheep stock club. Such matters may include the selection and procurement of certain types of sheep breeds, tups, hefting, drawing, lambing, selection of replacements and general improvements amongst others. It is important to define the role of the Committee / Board of Directors with respect to engaging outside contractors, setting internal payment rates and allocation of duties.

- Member Commitment – members should be fully aware of their obligations and responsibilities with respect to the sheep stock club. Such duties may well include an allocation of time, money or use of other facilities and/or resources to be used in furtherance of the sheep stock operations and activities.

- Livestock Management – all members of the sheep stock club have a duty of care to the livestock in their possession. Gathering, clipping dosing, handling etc. all require to be undertaken with due regard to the animals’ wellbeing. All members of the sheep stock club carry a duty of responsibility in this respect.

- Livestock Marketing - the member should be made aware of the sheep stock club’s policy with regard to routes to market and local sales.

- Allocation of Surplus – the member shall be advised of policy with respect to allocations of surplus.

- Duration and Termination of Agreement – the length of the agreement and how it can be terminated by both parties

- Assignation & Death – the rights and obligations of both parties on assignation or death

- Bankruptcy & Liquidation –to define what happens in event of a personal bankruptcy or business going into liquidation.

- Breach – the actions to be taken in the event of a breach by either party to the agreement and the remedies available.

- Arbitration – the actions to be taken when no resolution to a dispute can be reached.

- Modification of Agreement – the mechanism by which the agreement can be altered.

- Loans and Other Charges – provision for the member to make

- Force Majeure – defined as unavoidable loss

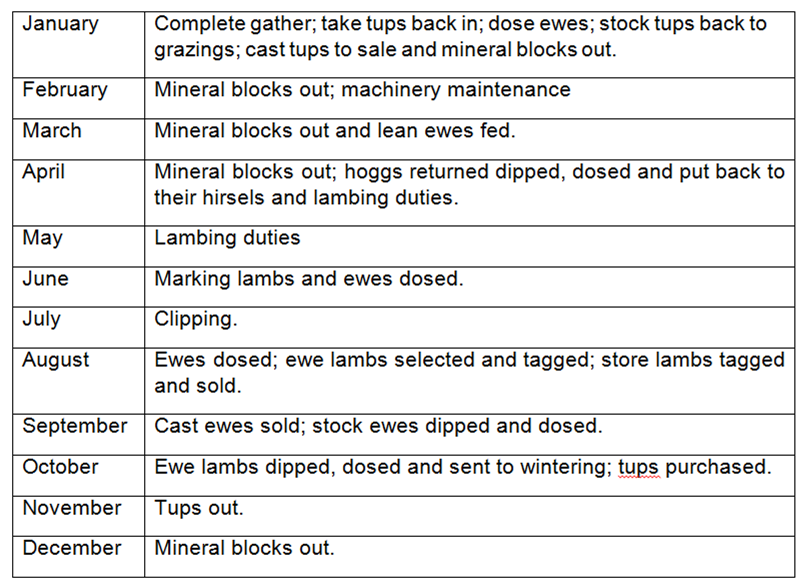

In terms of day to day operating operations, the annual calendar of sheep flock operations should be considered in light of individual responsibilities.

For example a typical sheep calendar for the Highlands and Islands might be –

It is important to make the member aware of what his/her contribution and commitment to the sheep stock club will be with respect to the overall programme and how the Committee / Board of Directors wish to resource and carry out the various operations.

It is also important to have the member’s agreement signed and witnessed by both two members of the Committee / Board of Directors and the individual member.

The members’ agreement for each sheep stock club will be different although there may be many points of commonality. Professional assistance should be sought to ensure that any agreement drawn up is fair, equitable and transparent, and that both parties have a clear understanding of their legal rights and obligations.

During the meetings many attendees raised the issue about the tax implications of grants and agri-environment schemes. There was also discussion about Mutual tax status. We sought professional advice on these topics, please see the two guidance notes below:

Succession is crucial for vibrant Sheep Stock Clubs - please see our practical guides for further information.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service