Agibusiness News September 2022 – Cereal and Oilseeds

1 September 2022Maize concerns underpin global prices

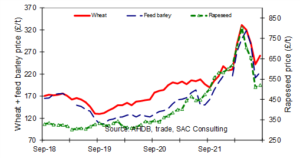

Good harvest progress and better than expected yields across most of Europe and the UK led to a sharp price drop in cereal prices in July.

More recently, concerns have grown over the later maize harvest in both the EU and USA, this has helped underpin the wider grain market. UK grain prices recovered in the last month with Nov ’22 LIFFE wheat futures up £2.90/t to £260.20/t in the last month.

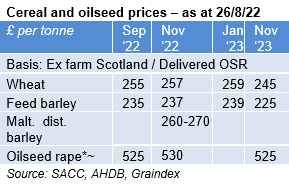

Cereal and oilseed prices (Scotland)

Source: USDA, IGC

While the severe drought and regular hot spells across Europe came too late to seriously affect wheat and barley crops, they have come at just the wrong time for the later maize crops. EU MARS crop reports forecast EU maize yields at 6.6t/ha (16% lower than the 5-year average) due to the hot dry conditions. If realised, this would leave total EU maize output at 60mt; the smallest crop since 2015.

In the US, more hot weather has affected maize production, with crop conditions reported at just 55% in good to excellent condition.

Ukraine grain exports deal holds

The deal to open Ukrainian ports for grain exports appears to be holding for now and export volumes are rising. Given the backlog of 20mt from 2021 harvest plus this year’s harvest, it will be many months before much of this grain will reach world markets. Nonetheless, these exports have helped ease supply concerns and global prices.

Although there are concerns that Russia may not continue to support the agreement; Russia gains considerably from the deal directly and indirectly.

Most OPEC oil exporters are major grain importers and if Russia had continued its blockade of Ukraine, they were threatening to turn the taps on, risking crashing the oil price that Russia depends on. Also, with a large wheat crop itself this year, Russia needs concessions on accessing shipping and insurance.

While this deal provides near term supply to world grain markets; the fact remains Ukraine’s grain output will be 30mt down this year and probably next year too and the conflict is likely to continue to underpin world grain markets.

UK harvest wraps up

According to AHDB, the UK cereal harvest was 95% complete by 26 August (vs 69% 5 yr av.) reflecting the hot, dry conditions this summer.

Yields have been variable but appear to be around or above average; wheat 8.2-8.6t/ha, w. barley 7.2-7.4t/ha, sp. barley and oats both 5.5-5.9t/ha and rapeseed 3.2-3.6t/ha.

Quality has been good with high bushel weights and clean samples. Malting barley premiums have been around £30/t over feed in England.

Scottish Harvest in demand

In Scotland, with 56% of the spring barley crop harvested, premiums are not yet set. Good harvest conditions and quality so far, yields still to be determined. Demand is expected to rise given new malting capacity in operation, so a larger malting crop is needed. UK malting demand rose 9% in the year to June.

Wheat use in distilling rose 23% in the year to June and rose 44% in June alone. High maize prices especially in drought torn France where distilling maize is sourced are likely to ensure Scottish distillers maximise local wheat use and maintain the strong Scottish wheat premium of £12/t over England.

Feed barley is currently at a typical £5/t discount to England. Again, high world maize prices help support barley demand in feed both at home and for export.

Julian.bell@sac.co.uk 07795 302 264

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service