Agribusiness News April 2023 – Cereals and Oilseeds

3 April 2023Wheat markets see price correction

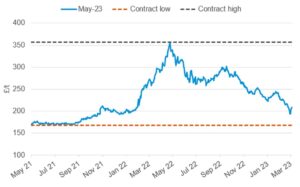

Against a backdrop of bearish market sentiment on pricing, wheat prices this week bounced back, prompting questions as to whether the market may have found its floor. Two weeks ago, UK ex-farm grain was trading at £209/t before losing £17/t last week, it has subsequently recovered some of those losses this week to currently sit at the £200/t mark. May ‘23 and Nov ‘23 Futures are currently trading at £210/t and £221/t respectively. All this illustrates the change in the dynamic of our domestic market as two months ago old and new crop prices were at near parity and now, we are seeing new crop Futures trading at an £11/ton premium to the May position.

May ’23 Feed Wheat Futures

Several factors continue to influence market movement short term. On the downside cheap Russian supplies are continuing to pressure markets and looking towards new crop, plentiful supplies are expected from Europe and US, despite the drought, due to the increase in planted area. The reality of the residual 2022 harvest surplus and lack of its export pace is also still weighing on price, although UK grain remains competitive at these price levels.

On the upside the institutional investors which had taken up short positions as prices were falling, have now closed them out, supporting a bounce back in price. And in a geo-political context there have been two announcements to support prices; Russia announced on Wednesday that top agricultural commodities trader Cargill will stop exporting its grain and Glencore-based crops trader, Viterra, is also reportedly planning an exit from the Russian market, adding to uncertainly over the future of shipments from Black Sea ports. As well as a possible reduction in Ukrainian supply, a major weather event between now and harvest, could see the tables turn. An adverse weather event, either in the US, here, or wider Europe is not uncommon at this time of year and would impact production for the coming harvest.

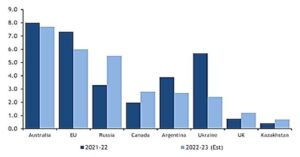

There is also uncertainly as to the volumes of barley supplied out of the Black Sea ports through 2023 and into 2024. Ukraine was the world’s third-largest barley exporter in 2021-22 and is expected to be ranked sixth this marketing season (see chart). But the country may lose further share of the global barley market in 2023-24, with limited supplies of about 1Mnt projected to be available for export.

Leading global barley exporters (Mn/t)

UK barley continues to price competitively within Europe, and the export campaign as of late has been strong. As of 20th March, so far this season, the EU had imported 824.6Kt of UK origin barley, up from 605.8Kt at the same point last season. Barley prices continue to be weighed on by movement in wheat markets. Discount of ex-farm UK feed barley to UK feed wheat stood at £15.50/t as of 16th March.

With Scottish plantings yet to get underway supply and demand is expected to be evenly matched which bodes well for malting premiums. The total annual requirement for malting barley in Scotland is around 900,000 tonnes (to 1Mnt this year), of which the majority is required for Scotch Whisky distilling. The total UK market for malting barley is around 1.8 million tonnes and so Scotland is a significant part of that total, despite having only around 10% of the arable area of the UK.

Bearish sentiment continues for rapeseed with the EU crop faring well. This decline is expected to continue as rapeseed supplies on the continent are forecast to increase.

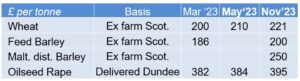

Indicative grain prices week ending 31st Mar 23 (Source: SAC)

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service