Agribusiness News April 2023 – Sector Focus: Budget Update

3 April 2023High-level outlook

On 15th March, Jeremy Hunt revealed his first UK Government budget, detailing plans for tax and public spending for this financial year. Alongside this, the Office for Budget Responsibility (OBR) shared fiscal forecasts for the next five years, accounting for policies in this budget. A number of announcements which will impact agricultural and personal finances in 2023 and beyond.

The energy crisis had a major detrimental impact on the entire UK economy. Now that the energy squeeze is abating, the economy is expected to contract less than previously thought, and the Government has slightly more fiscal space to manoeuvre. GDP will be higher than expected due to this easing of energy prices, as well as population growth from in-migration. However, real household disposable income expected to fall by 6% between 2021/22 and 2023/24. The UK is currently experiencing the steepest fall in living standards since records began in 1950s, which are not expected to return to pre-pandemic levels until 2028, the impact of the trade shock resulting from the energy crisis and structural weakness in economy.

Energy and fuel costs

The first move that this flexibility has allowed Government to take is to keep the energy price guarantee at £2,500 for a ‘typical household’ until June 2023, after which point prices are not expected to exceed this, anyway. The price cap is not a limit on bills, but is effectively a limit on unit price charge, based on units used by a typical household. Wholesale energy prices are falling and in July it is expected that the OFGEM price cap (which caps what suppliers can charge) will be lowered to around £2,200, below government support levels. In line with expectations, fuel duty will remain frozen for another year, including the previous five-pence cut.

Corporation tax

A planned increase from 19% to 25% for the top rate of corporation tax has been confirmed. Companies making profits below £50k will be fully taxed at 19%, those with profits over £250k will be fully taxed at 25%, while those falling between these figures will be taxed on a tapered scale. To help compensate for the increase in these tax rates, the Treasury have announced some additional changes.

Firstly, they have announced a provision for full expensing, called 100% First Year Allowance, from 1st April 2023 until 31st March 2026 (potential to be extended in future). Companies will be able to write off the full cost of qualifying main rate plant and machinery investment in the year of investment, while special rate assets will get a 50% first year allowance in the same period. Next, the Annual Investment Allowance is to remain at £1M, permanently. This is relevant to unincorporated business who do not qualify for full expensing, which will benefit many farmers in particular. Unlike full expensing, this will apply at 100% to “special rate” assets, unincorporated businesses, and second-hand assets. Lastly, eligible SMEs who spend more than 40% on research and development (R&D) will receive £27 from HMRC for every £100 of R&D investment they make.

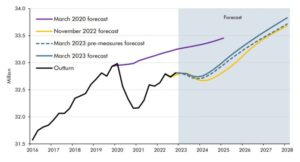

Figure: UK employment, millions. Employment is expected to get back ‘on track’ to pre-pandemic forecast (purple) around 2026/27. (ONS, OBR)

Increasing the workforce – parents

Hunt outlined his plans as a ‘budget for growth’ and the OBR forecasts agree, especially due to policies put in place to address falls in labour force participation. First of these is to expand free childcare for working parents of nine-month to two-year-olds (currently 30 hours per week for three- and four-year-olds). Although this provision is currently only available in England, the rest of the UK will receive reciprocal funding under the Barnett formula, so there is a strong chance that a similar scheme will be announced in Scotland in due course. The Budget also increases the requirement for more parents and carers claiming Universal Credit to increase their hours or seek work. Finally, a new disability employment programme is expected to further increase employment.

Pensions

Annual tax-free pension allowance will be increased from £40k to £60k. This generosity of tax treatment will be particularly useful for farming businesses who have seen exceptional profits within a year. Further to this the pensions lifetime allowance (currently £1.07M) is to be abolished. For those with more than this amount in their pensions (a very small proportion) will no longer pay tax on money taken from their pension savings that exceed the protected lifetime allowance (at 55%). These measures are expected to have a positive effect on employment.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service