Agribusiness News April 2023 – Sheep

3 April 2023Input prices affect performance

The lamb trading year has been fairly distorted with high input costs. Resulting in producers reducing the amount of inorganic fertiliser and purchased feed in sheep systems. This has had a knock-on effect on lamb growth, meaning excess lambs in the marketplace now late in the season affecting the price.

Festivals drive trade uptick

Prime and cull trade is improving, as would be predicted with Ramadan (23rd March – 21st April) and Easter (9th April) approaching. This year will see the first Muslim festival, Ramadan in a cost-of-living crisis. AHDB have predicted that there will be a trend of a transition from lamb to cheaper meats such as mutton and chicken or cheaper cuts e.g., mince and shoulder. The recent strong demand for ewes possibly demonstrates this already happening. In 2021 Muslim lamb sales accounted for 20% of UK lamb sales, to put this into perspective, 6.5% of the UK population is Muslim.

Australian flock growth a threat

Meat and livestock Australia has recently launched their sheep industry forecast, with some frightening stats on their national flock growth. In 2023 the sheep flock will be the largest it’s been in over 15 years at 78.75 million head, a 13% rise on their 10-year average. This is set for a further rise in 2024 to 79.5 million head (750,000hd increase!). Before dipping down to 78.52 million head in 2025. The reason for the increases is due to good breeding conditions, due to favourable weather, a national investment in flock genetics, high lambing % and confidence in the sector, looking at global opportunities.

These global opportunities include the decrease of the NZ flock due to land use changes (tree planting) and the dairy herd increasing, a declining US national flock and high global demand for protein. In addition, the Australians see great opportunity within the UK, with trade deals allowing for better market access and the seasonal dips of supply in the UK. They have a keen eye on our inflation increasing and the possible removal of subsidy which will both put extreme pressure on our production. With their increased flock, combined with the reduced NZ flock, they are preparing to grow this market into the UK over time.

However, our domestic flock is also growing, while the French flock is shrinking. The UK sheep industry is fully integrated to export chilled lamb and import lamb to smooth out seasonal supply, but is there enough demand and margin to take more Australian, and can the consumer pay for UK lamb?

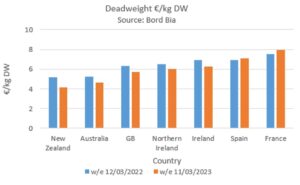

Source: Bordbia

Kirsten.Williams@sac.co.uk; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service