Agribusiness News April 2024 – Milk

1 April 2024Poor start to the spring flush…….

- Milk volumes are increasing as we head into the spring.

- The two latest GDT auctions showed negative results for dairy commodities sold.

- Milk prices have been increasing but how far they go will depend on grass growth, grazing conditions, and the extent of the spring flush.

Milk production data

The latest milk production data from AHDB shows that GB milk output for February was 975m litres (provisional), 4.8% less than the January volume. Daily deliveries were 34.91m litres for the w/e 16th March, 1.2% above the previous week and 0.3% more than the same week in 2023. Unfortunately, UK data from Defra on February’s volume and the average farm-gate milk price was not available at the time of writing.

Farm-gate prices: April 2024

The most up to date milk prices from the main Scottish milk buyers available at the time of writing are shown below. Both First Milk and Müller have increased their April price by 0.75ppl and 1.0ppl respectively.

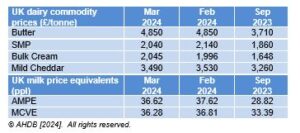

Dairy commodities & market indicators

The latest UK wholesale dairy commodity prices for the week beginning 19th of February to the 11th of March only showed a positive price movement for cream (+2%), which firmed on the back of higher butter prices at the end of February. The 5% fall in SMP compared to the previous month reflects the downward price movement seen in recent GDT auctions. Buyers short-term needs are covered and are not looking to purchase too far ahead as they anticipate prices falling as milk volumes continue their seasonal increase. As a result, the market indicator AMPE fell 1ppl on the back of the lower SMP price and MCVE fell by just 0.53ppl due to weaker mild cheddar.

The latest GDT auction (19th of March) returned a 2nd drop in a row in the average price, across all products sold, down 2.8% to $3,4974/t. These last two negative auctions follow six consecutive price rises since early December. At the latest auction, skim milk powder and whole milk powder dropped 4.8% and 4.2% respectively from the previous auction. Butter and cheddar showed more modest declines.

Dairy farm business income

While results just published by the Scottish Farm Business Survey showed that dairy farms had an average Farm Business Income (total output minus total costs) of £248,700 in 2022/23, up 42% from the previous year; in contrast, in mid-March Defra published their dairy Farm Business Income forecast for 2023/24 of just £50,000, down a staggering 78% from £248,300 in 2022/23. This drop was almost solely attributed to the lower farm-gate milk price as opposed to less dairy cows or a drop in milk output.

Recent monthly costings data published by Promar for December 2023, indicated that while feed costs have fallen 13% compared to 12 months, ago, milk price was back 26% and therefore the margin over purchased feed (in ppl) was down by 31.3%.

Global outlook for 2024

Rabobank predicts that during 2024 gradual, small positive price movements will be seen in the dairy commodity markets. It is expected that, while milk volumes will be back in the first half of the year, volume growth will be seen in the second half of 2024 on the back of lower feed prices and better margins, aiding a return to profitability.

Global demand for dairy products has been sluggish so far this year, but economic growth is looking up as the fear of recession in some countries has now passed.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service