Agribusiness News April 2024 – Policy Brief

1 April 2024New Land Maintenance Form

The Scottish Government have introduced a new Land Maintenance Form (PF06) to simplify and expedite the process of making essential land changes to land parcels. To access the new form and initiate land parcel changes where required please visit the Rural Payments and Services website.

Wildlife Management and Muirburn Bill

The Wildlife Management and Muirburn (Scotland) Bill has now been passed. Its main remit is to protect wildlife. The new Bill bans the practice of snaring and the use of glue traps to catch rodents. It also gives greater powers to the Scottish SPCA to tackle wildlife crime and introduces a new licencing framework for grouse moors.

Land Reform Bill

The new Land Reform (Scotland) Bill is aimed at changing how land in Scotland is owned and managed in rural and island communities. Measures include in certain cases, prohibiting landholdings over 1,000 ha from being sold until Ministers can consider the impact on the local community. This could lead to some landholdings being lotted into smaller areas and/or communities being given the opportunity to take on ownership of some or all of the land in question.

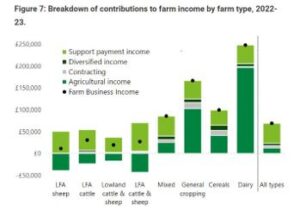

Farm Business Survey

As the Scottish Farm Business Survey is Scottish Government’s primary source for economic modelling of the impact of future policy change, the farm income by farm type 2022-23 figures (chart below) highlight that, while on the whole general cropping, cereal arable and dairy units are profitable without support; livestock farms, largely remain unprofitable without support due to increasing costs of production. Recent and sustained high prices for livestock may go some way to reversing that trend.

Spring Budget

National Insurance

- From the 6th of April 2024, National Insurance contribution for employees will be reduced by 2% from 10% down to 8%. This is in addition to the 2% reduction applied in January 2024.

- For self-employed (Class 4) contributions where business profits exceed £12,750, National Insurance contributions are being reduced by 3% from 9% down to 6% including the 1% cut announced in the Autumn Budget statement.

VAT Registration

- From the 1st of April 2024, the 12-month taxable turnover threshold which determines whether a person or business must be registered for VAT increases from £85,000 to £90,000.

- Conversely, the 12-month taxable turnover threshold for de-registration for VAT increased from £83,000 to £88,000.

Furnished Holiday Lets

From the 6th of April 2025, the Furnished Holiday Lettings (FHLs) tax regime will be abolished. The intention of this is to remove the current tax advantage for landlords who let short term furnished holiday properties over those who let out residential properties to longer term tenants.

Under Capital Gains Tax reliefs, holdover/rollover/Business Asset Disposal (BAD) reliefs will no longer be available on disposal of a property.

While currently under the scheme, FHLs qualify for plant and machinery capital allowances on items such as furniture, equipment, and fixtures. Going forward, allowances will only cover replacement of domestic items. In addition to which, mortgage interest will no longer a fully deductible expense.

Christine Beaton, Andrew Coalter & Sascha Grierson

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service