Agribusiness News August 2022 – Cereals and Oilseeds

3 August 2022Markets adjust to post-conflict impacts

Markets have been mixed as macroeconomics, dry and hot weather globally and Black Sea uncertainty continue create a nervous and volatile trading arena.

Underlying the current volatility, tight global supply persists. The International Grains Council has forecast global 2022-23 wheat and coarse grain production at 2,255Mt compared with output of 2,290 Mt in 2021-22 and end of season stocks at 583Mt (607Mt in 2021-22). Within these figures the Ukrainian 2022 wheat crop is forecast at 18.2Mt (a little over half its 32.2Mt output in 2021) and maize at 27.7Mt (42.1Mt in 2021). On the flipside, Russia’s IKAR agricultural consultancy has raised its wheat production estimate for the country to 90.5Mt, up 1.8 Mt on its previous estimate and it is becoming evident that Russia is expected to have a 45Mt surplus to export.

However, all of the historic ‘war premium’ built into the wheat futures values of late, has evaporated with market falls of over £100/t seen off the highs experienced back in May. There was evidently an over-correction as the hedge funds sold commodities from energy to gold to grain. Since then, the market has tried to recover, but keeps getting knocked back by the inevitable northern hemisphere harvest pressure now underway. Which way the market swings now, will depend in part on the success of the deal brokered to trade out the 20Mt of Ukrainian grain purportedly sitting dockside. Questions around whether insurance companies will insure vessels leaving the mined waters, and the recent strikes on ports, are also adding to uncertainty.

Legislation intervention

The EU Commission, in recognising the future threats to food security, has adopted a temporary short-term derogation from conditionality rules on crop rotation & maintenance of non-productive areas in a bid to increase the EU’s cereal output. Following repeated requests from Member States, the Commission tabled a proposal seeking derogations from GAEC standards 7 & 8 limited to claim year 2023 in a bid to maximise the EU’s production capacity for cereals aimed for food products.

The impact of the measure will depend on the choice made by national capitals & farmers, but DG AGRI estimates show that it could put back 1.5 million hectares in production compared to today. In practise this is a reversal on the 3-crop rule and EFA requirements in EU Member states.

Harvest ‘22 progress

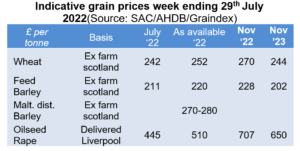

Progress on the continent is reported as positive with optimistic outlooks given particularly for quality. French farmers are over 50% harvested on soft wheats with best crops being to the north and east of the country. Germany too, cites promise in their harvest, offsetting some earlier concerns. This picture is reflected here in the UK with the market buyers at ease with yield estimations for feed barley harvest currently sitting at 10% over ‘average’. As – available prices have come under pressure as a result as sellers look for outlets but the favourable carry in forward pricing is aiming to incentivise growers to hold crop on farm.

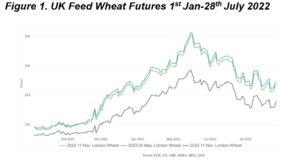

In Scotland the harvest has yet to prove itself with concerns particularly for light land performance given the dry season. Some growers will still have malting barley contract premiums to sign off on, frustrated perhaps by the absence of buyers committing to a premium earlier in the year. With UK feed wheat futures (Nov-22) back to £270/t (28th July) (Figure 1) its reason enough to tie up any remaining spring barley contracts for early movement and help generate funds for post-harvest cash flow requirements.

Market sentiment is currently favouring wheat and rape as the longer-term holders into 2023, with barley more potentially exposed to price pressures later in the season coming from any UK surplus that develops and therefore initiates a requirement to export.

mark.bowsher-gibbs@sac.co.uk, 07385 399513

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service