Agribusiness News December 2022 – Cereals and Oilseeds

1 December 2022Black Sea exports hold & eyes on China

It seems that for most of 2022 we have been reporting on diminishing world grain stockpiles, and now according to the International Grains Council we are currently at an eight-year low for global grains stocks and a ten-year low for global maize stocks. At the same time, the World Agricultural Supply and Demand Estimates (WASDE) report from the USDA increased its estimated figures for global supply, consumption, trade and ending stocks. Global supply (by way of example) is raised to 782.7 Mt, however South America supply remains a key concern with persistent dryness forcing the USDA to lower its Argentinean wheat crop estimate by 1.5 Mt to a new total of 15.5 Mt.

The report kept Russian wheat production at 91 Mt despite most estimates from the trade being closer to 100 Mt. The exports estimate remains at a sizeable 42 Mt, which would require an average of 3.5 Mt of exports each month to realise. Ukraine’s grain exports by contrast reached 15.6 Mt by mid-Nov, down 31% on the year. This total includes 6 Mt of wheat, 1.3 Mt of barley and 8.3 Mt of maize. In October, around 4.2 Mt of grain left Ukrainian ports. It’s expected that this figure will not reach 3 Mt for Nov; a key watch point for markets.

Global supply remains understandably tight, and markets continue to react to this news from Ukraine. Slower than expected Ukrainian exports could support markets, but recessionary concerns and questions over Chinese demand outweigh this in the short-term.

For maize, tight global supply keeps prices elevated in the long and short-term, but recessionary concerns could limit any rises. South American plantings will be something to monitor over the next few weeks.

UK Wheat & Barley Supply v Demand

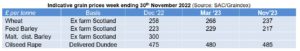

The UK picture remains fluid with a large crop and surplus chasing limited consumer demand. What looks like continued lower demand in most sectors in the UK, from livestock to ethanol, means we will continue to follow global pricing trends. However, prices remain relatively strong as questions around global supply reaching the market persist.

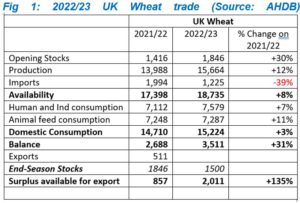

The AHDB recently released early balance sheet estimates for UK wheat and barley for 2022/23 (Fig 1&2). Larger wheat carry-in stocks, combined with a rise in production outweighs the increase in usage, leading to a substantial exportable surplus for 2022/23 of circa 2 Mt. With the UK being the cheapest or second cheapest wheat in the world since harvest, we could see all our surplus exported by the Spring; any imports required thereafter would however be very costly; note to the feed sector.

For barley,(Fig2), lacklustre demand from the animal feed sector (-5%) and higher production (+3%), is expected to lead to a larger surplus, but the balance sheet remains relatively tight in a historical context.

UK maize usage is expected to continue to be capped by higher domestic availability of other grains. Oats, meanwhile, have seen another bumper crop leading to another year of high exports forecast.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service