Agribusiness News December 2022 – Input Costs: Energy

1 December 2022Developments to date

While natural gas prices have fallen to levels consistent with previous years, the future of Europe’s energy markets remains uncertain. A strong rebound in demand in 2021 followed by the outbreak of the war in Ukraine in 2022 caused natural gas prices to increase sixfold in one year, peaking in the UK at 702.95 p/therm on 26 August.

The price has been driven up due to the ongoing economic battle between Russia and the West. Russia accounted for 45% of Europe’s gas imports in 2021, however they have been shutting off the tap: Russia has decreased its gas supply to EU states by 88% over the past year, closing the Nord Stream pipeline indefinitely in August. The EU has responded by sourcing its gas from elsewhere and is scheduled to cease all seaborne imports of Russian gas this December.

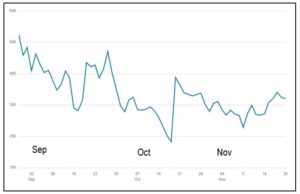

Figure: UK national benchmark price of natural gas, Sep-Nov 2022. Units are pence per therm, where 1 therm = ~100 cubic feet of gas = ~100k BTUs. Source: BBC.

A (brief?) respite

The squeeze on supply has subsided for the moment and gas prices have come back down. Record-breaking imports of liquified natural gas (LNG) from the USA, a warm October, and a strong supply from wind power have contributed to the UK price falling 66% from the August peak, now similar to last year’s prices. There is continuing uncertainty about how prices will move in the near term. High pressure forecasted for December could bring less wind and colder temperatures, pushing prices back up somewhat. European states are scrambling to dismantle their reliance on Russian gas, both seeking deals with alternate suppliers like Qatar and building input terminals or floating plants at ports, which are required to turn the LNG back into useable gas. However, these changes will take time to come online and, if Russia cuts all gas supply to Europe in 2023, there will be a shortfall of 140 billion cubic meters of gas (equal to 27% of the current LNG market). This type of economic war of attrition hurts both parties – decreasing use of cheap Russian gas will lead to rationing and deepening economic recession.

Knock-on effects

Synthetic fertiliser price is driven by natural gas, which accounts for 60-80% of input costs to this industry in Europe. Skyrocketing gas prices have caused many facilities to reduce or halt production, including CF Industries at their Billingham site in late August. Decreased domestic production has made the UK dependent on expensive imported ammonium nitrate (AN) (£870/tonne in Sep, 120% increase over Sep 2021). Because of its link to natural gas, fertiliser price is similarly uncertain. Continued price volatility and the weakness of sterling means imports will remain expensive. There are a few mitigating circumstances for farmers: Dry weather before this year’s harvest reduced fertiliser application for some and grain prices are strong. In the 2023 season, the trade-off between additional yield from increased fertiliser application and input cost of fertiliser requires close attention. High winter rainfall this year may reduce UK soil nitrogen supply; Farmers should plan to do soil pH tests in the spring to optimise fertiliser use.

Looking ahead

While natural gas prices have come down, the summer price spike has lingering effects. The closure of facilities like the CF Industries site means fertiliser prices will be slower to fall; other dependant products like AdBlue, required in diesel engines to neutralise nitric oxide emissions, face major shortages. Finally, electricity and heat generation has reverted to coal in some countries, which releases at least twice the CO2 per unit of electricity produced, plus other harmful air pollutants. A major takeaway from this energy crisis is the urgent need to accelerate our energy transition to a mix of local and renewable sources. This change will be expensive, as well, but will result in massive long-term savings through protecting countries from costly price shocks and mitigating the worst of climate change fallout.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service