Agribusiness News December 2023 – Milk

30 November 2023Stagnant milk volumes and greater demand boosts commodity prices

- Milk volumes are now over 3% below this time last year.

- Industry analysts suggest milk prices have reached the bottom and should start to improve in Q1 and Q2 of 2024.

Milk production data

GB milk output for October has been estimated at 1,006m litres (AHDB), 4.5% more than the previous month and 2.6% below October 2022. Daily deliveries were 32.49m litres (as of w/e 18th November), 0.4% above the previous week but 3.2% less than the same week in 2022. UK production for October was estimated at 1,185m litres.

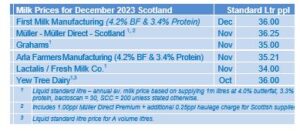

Farmgate prices: December 2023

Milk prices will likely be holding steady from the majority of processors given the uplift in commodity prices and stagnant milk volumes. First Milk has confirmed a price hold for December, but other prices in the table below are for previous months. The Defra average UK milk price for September 2023 was 36.36ppl (October price not updated at time of writing), up 0.16ppl from August.

Dairy commodities & market indicators

Dairy commodity prices continue to rise, with all products traded between 23rd October and 20th November showing an average price increase from the previous month. Butter and cream showed the biggest rises, up 13% and 11% respectively.

With milk supply continuing to be well below last year’s volumes, butter stocks are tightening, and demand is starting to increase for the festive period. Export demand for cream to the EU has also picked up on the back of falling milk supplies on the continent. Mild cheddar has shown a bigger rise compared to last month, as demand improves both at home in the run up to Christmas and for export for the US thanksgiving holiday. Therefore, market indicators AMPE and MCVE have also risen from last month, with AMPE 1.14ppl above MCVE.

The Milk Market Value was up 2.2ppl to 36.76ppl for November, the highest it’s been since March. After four consecutive price rises in the GDT auction in September and October, the two auctions in November have been flat, with a -0.7% and most recent 0% change in the average price of all products sold. The latest average was $3,268/t, with the biggest mover being cheddar, down 9.7% to $3,637/t.

Cost of production and feed costs

The cost of production is currently around 37ppl which is above what many Scottish milk buyers are paying (depending on contract). For October, the Milk Price to Feed Price ratio calculated by AHDB and Defra, was 1.18, much lower than 12 months ago (1.39). This ratio indicates the value of milk in related to purchased feed costs. At 1.18, milk production is only just in the stable zone. If below 1.16, a reduction in milk output is expected.

The most recent costings data from Promar’s Milkminder for September had a purchased feed cost of 11.93ppl, with a daily yield per cow of 25.57 litres and a milk price of 35.98ppl, returning a margin over purchased feed of 24.05ppl, compared to a margin of 35.68ppl 12 months ago.

Producer numbers fall

AHDB’s latest survey of milk buyers has shown that dairy farmer numbers have fallen to 7,500 as of October 2023, an estimated 350 less than this time last year. Not surprisingly, the reduction has been attributed to declining returns, with the milk price having fallen on average 13ppl in the last 12 months and high input costs for energy, feed, fuel, and fertiliser. While these have eased in the past few months, they are still significantly higher than pre-Ukraine war.

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service