Agribusiness News February 2023 – Cereals and Oilseeds

2 February 2023UK market looks to US weather events

The UK began 2023 with a sizable exportable surplus of wheat following higher initial carry-in stocks and a rise in output from the 2022 harvest over 2021. A fall in wheat imports too has led to the increased availability we are currently experiencing, and estimates put the UK surplus at 2.25Mt, more than double last year’s surplus and the highest for several years. The barley balance sheet remains tight however, despite seeing a rise in production and a fall in animal feed demand. Maize usage has been capped by more competitively priced and readily available domestic grains. Oats are seeing a strong run on exports following another sizable crop.

Total cereal demand for animal feed for 2022/23 is expected to be the lowest for 5 years driven in principle by the monogastric sectors. Poultry feed demand is declining in the face of tighter producer margins (egg producers particularly), avian flu impacts and general falling consumer demand associated with the rising cost of living. With the national pig herd reducing in size, pig feed production is anticipated to fall back from last year’s highs as well. Cattle feed demand is expected to remain stable, however.

By way of contrast, wheat use for the bioethanol and starch industries is expected to increase by 8%, more than offsetting the decline in flour miller demand.

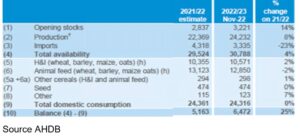

Figure 1. UK Cereal Supply and Demand Estimates (000 tonnes). As of Nov 22

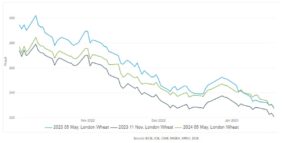

The 25% increase in the differential between total cereal availability and domestic consumption (Figure 1 line 10) compared to last year is part of the reason we’ve seen Wheat Futures prices continue their steady downward run since early October (currently £226/t for May’23); a fall of £50/tonne over the last 4 months (Figure 2).

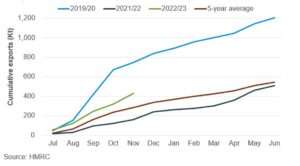

Come the spring, we may see prices firming as our domestic surplus stocks continue to clear (Figure 3). Recent rains in the US central belt however are adding further pressure on prices in the UK currently.

Figure 2. May ’23 Wheat futures prices Oct 2022 – Jan 2023

The feed barley market remains quiet meanwhile; demand is slow across Europe and North Africa markets are opting for maize and wheat over barley.

Figure 3. UK wheat export progress compared to previous years

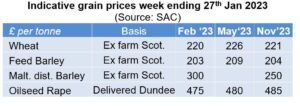

Malting barley in Scotland enjoyed a favourable harvest in 2022 and traded at premiums in the region of £50/tonne over feed; a considerable increase over the previous three year’s premiums which remained below £20/tonne. Supply and demand could be tighter in 2023/24 with new malt processing investments coming into production and an expected 5% reduction in area to be sown this spring Demand is expected to reach, and possibly exceed, 1Mt and supply looks marginal without good yields. Oilseed rape continues to come under pressure falling through €550/tonne on the May Paris Futures; current delivered price into Dundee is £445/tonne.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service