Agribusiness News March 2024 – Cereals

1 March 2024Sea Freight cost rise

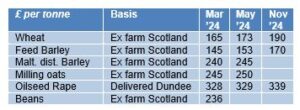

Domestic wheat futures followed EU and US wheat markets up at the end of February as low prices seem to have led to a slight uptick in global demand. UK feed wheat futures (May-24) closed February out at £165.00, up from £160.00, two weeks prior. The Nov-24 contract gained £3.80/t over the same period, ending February at £182.30/

In the meantime, grain exports from the Black Sea continue to flow and the war has effectively become part of the political background pressure for markets. The hostilities both in Eastern Europe and the Middle East are hindering sea trade too. More recently, commercial ships on the Red Sea have been attacked by Yemen-based Houthi rebels who claim their actions are in response to Israel’s counterattacks in Gaza after Hamas attacked Israel on Oct. 7th. As a result, several of the world’s largest shipping firms including Maersk, Hapag-Lloyd, and the Mediterranean Shipping Co. have suspended shipping through the Suez Canal, a passageway that connects the Red Sea and the Mediterranean Sea. Some carriers are diverting their shipments to Europe and the United States via the Cape of Good Hope, adding weeks to the journey and increasing costs. Not surprising therefore that the IGC Grains and Oilseeds Freight Index was up 19% year-on-year in December and no doubt costs will have been passed on to the processor and consumer.

Overall wheat prices in Europe have been capped both by higher global maize supplies expected out of South America, (notably Argentina and Brazil) and slow EU wheat export demand coupled with rising in-house inventories. Maize, into the UK, is consequently anticipated to increase by 9% this coming season.

UK trade

With the UK wheat supply and demand balance 31% tighter this year than last year, wheat exports are expected to be at minimum levels for 2023/24. Exports are currently forecast down from last season by 83% and the UK is expected to be a net importer this season and next aligning with AHDB’s early indications of a 2024 wheat harvest of between 12-13Mt. Currently fresh farm supplies are just about accounting for the slow consumption offtake and limited buying activity.

For feed barley, export pricing is uncompetitive, and exports are currently forecast for this season down 38% from last season. With a move from winter to spring cropping for harvest 2024 expected, the size of the barley crop remains a key watchpoint for new season export values.

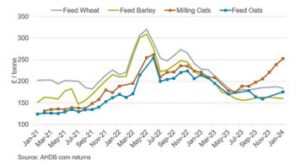

Milling oats prices are achieving highs not seen since Jun ’22 (AHDB quoting £252/t Jan ’24 ex-farm) with substantial premiums over feed quality exceeding £70/t in early 2024 (Fig 1).

Fig 1 Strengthening milling oat values

Oat exports this season have hit a stronger pace than expected, especially considering the tighter oat supply and demand balance year-on-year. This season, UK oat exports are in line with the previous five-year average. Looking ahead, oat supply is expected to see a boost for harvest 2024 due to a larger intended planted area. This could see strong exports continue in 2024/25, providing the UK stays price-competitive to the continent.

Global factors mean OSR prices have fallen sharply. As of early February 2024, domestic OSR spot delivered prices were over £200/t lower than the peak in 2022. The lower prices combined with the 2023 harvest not delivering, means a drop in the OSR area for 2024 harvest is anticipated. The 20% price drop seen over the last 12 months is partly due to cheaper Ukrainian oilseed rape coming into the European market. Further to that, the overall bearish sentiment of the soyabean market has weighed on prices as record South American soyabean crops are starting to come to the market.

mark.bowsher-gibbs@sac.co.uk, 07385 399 513

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service