Agribusiness News February 2024 – Cereals

1 February 2024Price pressure continues for wheat

January closed out with a notable disconnect between the US and European markets, with Chicago wheat reporting modest gains fuelled by short covering. In contrast, both UK and Paris wheat markets experienced further declines amid ongoing worries over Europe’s trade balance considering fresh easing in Russian prices.

UK feed wheat futures (May-24) passed through £177.40/t on the 29th of January marking a £17/t decrease in value for this position since the first day of the New Year. Similarly, new crop futures (Nov-24) have declined £12/t in value through January.

European markets have faced challenges from intense competition in the Black Sea region, partially offset by the weakening euro against the US dollar. The conflict in the Red Sea has heightened competition for grain sales in North Africa and Europe. Disruptions in Asian markets, typically reliant on Russian and Ukrainian grain, are favouring Black Sea supplies, putting additional pressure on European grain markets. Ukraine’s improved export capabilities through an alternate Black Sea corridor, further shape the market dynamics.

Despite falling prices, UK feed wheat still remains around £10/t too expensive to compete for an export market share and season-to-date exports (July-Nov) are down by 71% compared to the same period in 2022-23 as traditional EU export destinations like Spain and Ireland continue to find cheaper offers from alternative sources. The forecast for wheat ending stocks in the UK now predicts a 30% increase from the previous year due to this lack of export competitiveness and gives rise to a rather unusual situation of having larger end of season stocks despite a smaller crop.

These wheat ending stocks are projected to be 2.552 million tonnes, up from 1.953 million at the end of 2022-23. Imports will be considerably up too, expected to reach 1.725 million tonnes in 2023-24, with a focus on high protein milling wheat due to domestic quality concerns and uncertainties surrounding the 2024 crop.

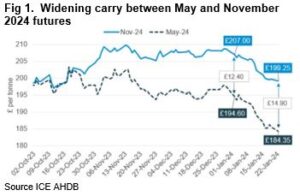

Domestic demand in the feed and ethanol sectors has been below expectations also contributing to falling UK feed wheat prices. The option to carry old crop into the next season becomes increasingly attractive for those that can do so, with the carry from May 2024 to November 2024 futures reaching £15/t.

Markets for barley/OSR/beans

Old crop feed barley prices continue to decline, maintaining a historically wide discount to wheat. Barley remains competitive in feed formulations and compounder demand has reappeared particularly for pre-harvest positions, but domestic demand struggles amid a surplus due to a lack of export pace. New crop feed barley generally remains at attractive discounts to wheat.

Rapeseed values increased substantially in mid-late January as European crushers sought further cover. In the UK, this triggered some farm selling at around £350-£360/t ex-farm. Australian growers have been resistant to selling at current prices, influenced by delays in passage time through the Red Sea.

Bean values remain stubbornly fixed but are facing increasing challenges as cereals and imported proteins continue to decrease in price, potentially pushing them out of mainstream rations. Despite indications of unsold tonnage, the balance sheet suggests selling beans at current firm prices could be a prudent move for growers, even for later delivery in the year.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk 07385 399 513

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service