Agribusiness News February 2024 – Sheep

1 February 2024From a Land Down Under

The 1st of January 2024 saw Year 2 of the Australian Free Trade Agreement begin. Where an allowance of 30,556 tonnes of sheep meat can enter the UK with no additional tariff costs to exporters until the end of December 2024. As a reminder, Year 1 was a short year from May through to December 2023, where there was an allowance of 14,726 tonnes.

While in 2023, figures from Meat & Livestock Australia show that Australia exported a record-breaking total of 326,014 tonnes of lamb and 209,580 tonnes of mutton, only 2% of the exported lamb came to the UK.

With a year-on-year increase of lamb exports of 30% (to 67,763 tonnes) and an increase of mutton exports by a staggering 70% (to 97,481 tonnes);China is Australia’s largest market.

The second largest export market in 2023 for Australia was the Middle East and North Africa, where a 63% increase in volume (up to 95,889 tonnes for sheep meat) was seen compared to 2022.

While sheep flocks are declining in many countries, due to an increasing global population/demand for protein, the Australian flock is increasing.

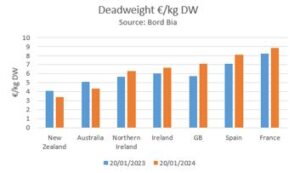

Farm Gate Prices – A downside to the Australian flock increasing supply is falling prices.

With a lower lamb price, compared to other exporting countries in 2023, it is clear to see why importing countries such as China and the Middle East, have increased their imports of Australian lamb.

As Australian sheep producers struggled with drought conditions in the third quarter of 2023, this stimulated more sheep being forward for market due to people destocking. This high number of sheep coming forward severely affected their end price, with a low of 220.9p/kg in September. However, at the end of Nov/start of Dec, the Australian price recovered and has overtaken the New Zealand price.

New Zealand Lamb – With a low NZ lamb price of €3.37/kg (end of week 20/01/24) compared to a Great Britain price in the same week of €7.10, with countries such as China and the Middle East expanding their imports from Australia, could mean that an increased level of NZ lamb is targeted towards the UK in the coming months.

Closer to Home we are approaching a time of high demand for sheep meat with the Muslim fasting festival – Ramadan looking to commence on the 10th of March, with the completion of this month long fasting, ending with Eid-al Fitr on the 9th/10th April – as well as Easter being on the 31st of March.

However, this offers a great opportunity for the NZ product to target our supermarket shelves and compete with our home grown produce.

Is 2024 going to be the year for lamb?

This year so far, the prime lamb market has been very similar to 2023. DEFRA data has shown that there was ~1 million less lambs in the national flock in 2023 compared to 2022.

There were also less store lambs sold in 2023 compared to previous year. So, with a low carry over of hoggs into 2024, this should drive the spring prices.

Currently, the store ring is at a premium, with lamb values being around 20% higher than the start of the year, showing the confidence in the sector.

While the NZ lamb, may interfere with our easter and Ramadan market, the European export demand is strong, which should keep prices at a premium through hogg trading.

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service