Agribusiness News January 2023 – Milk

22 December 20222022: A year of rocketing input costs and record highs farmgate milk price

- Farm input costs have continued to increase throughout 2022.

- Farmgate milk prices have increased to a record high throughout the year to help cover rising input costs.

- A high farmgate milk price has produced a recovery to milk output, especially during the final quarter.

- Towards the end of 2022, dairy wholesale prices have weakened in response to increasing supply stock.

2022 has certainly been a bit of a rollercoaster for the dairy sector, with input prices and farmgate milk prices experiencing unparalleled highs. Fertiliser prices remain high, feed prices continue to rise even further, and following the Russian invasion of Ukraine, costs for fuel, electricity, and power have shown little sign of easing. This all sounds like doom and gloom but 2022 has not been all bad! The negatives have been countered by some significant positives. During the 2022 calendar year, we have seen the average UK milk price increase by 42% from 35.43ppl to 50.44ppl for October 2022 (UK farmgate milk prices for November and December 2022 are not available from DEFRA at the time of writing). The high milk price has helped keep UK production on a broadly similar track to 2021 (see below). Nonetheless, dairy prices are subject to supply and demand, just like any other market. Whilst supplies for liquid milk are broadly in balance within the UK market, increasing stock of dairy commodities within the EU means that downward pressure on prices is looming.

AHDB milk production data shows that output for November 2022 is estimated at 1,197.84m litres (before butterfat adjustment) – an increase of 35.12m litres on a year-on-year basis. Cumulative UK production for the 2022/23 milk year to the end of November 2022 stands at 9,989.41m litres (before butterfat adjustment), which is 32.37m litres lower output compared with the same time last year. The UK average milk price for October 2022 is estimated at 50.44ppl, an increase of 1.64ppl from the previous month (48.80ppl) and a year-on-year increase of 17.78ppl from October 2021.

2023: Downward pressure on prices predicted for the New Year

Towards the end of 2022, dairy wholesale prices started to show signs of weakening and this is clear to see with the reduction to the value of AMPE from 51.27ppl for October 2022 down to 44.69ppl for November 2022. In 2023, high food price inflation together with rising interest rates are likely to result in a further weakening of dairy markets as growing numbers of consumers try to be savvier with their weekly shopping budgets in in response to reduced purchasing power. Although some growth is predicted for global milk output in 2023, growth is likely to be modest if farm input costs remain at their current levels. Production growth in 2023 may also be limited by price reductions, depending upon the extent of any downturn in the market.

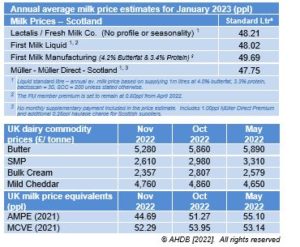

Some milk buyers have already started to react to changes in dairy markets. South of the border, Meadow Foods, Freshways, and Pensworth Dairy have all announced price cuts for January 2023. Meanwhile, in Scotland, Müller and First Milk have both confirmed a hold on prices for January.

To date, announcements for January 2023 include:

- Müller Direct – Price hold confirmed for January.

- Müller organic – As above, a price hold has been confirmed for January 2023. The organic farmgate milk price holds at 56.00ppl for January 2023.

- First Milk – FM has confirmed a hold on prices from December 2022 into January 2023.

- Fresh Milk Company – No change confirmed as yet.

Dates for the Diary

- Semex Conference: 15th – 17th January 2023

www.semexmarketing.co.uk/conference-2023-new

alastair.beattie@sac.co.uk, 07771 797 491

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service