Agribusiness News January 2024 – Cereals

1 January 20242023: Year in review

We move out of 2023 with commodity markets quietening down from the more volatile price movements that have characterized the past two years. Prices for most grains and oilseeds are 15-20% below early 2022 levels, having fallen back as global production prospects look more favourable than they did in late summer. Despite a slowing global economy, demand for agricultural products remains strong and is expected to hit record levels in the 2023/24 marketing season. Lower prices however mean significantly reduced profitability for grain and oilseed farmers in 2023, only marginally mitigated by lower costs for fuel and fertilizer.

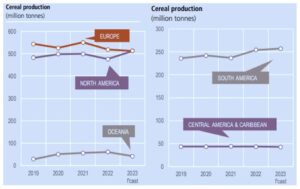

At 2,823 Mt, global cereal production for 2023 is up 0.9% (25.9 Mt) year-on-year and 10.4 Mt above the previous record high reached in 2021. The expectation for global wheat production in 2023 is 787 Mt, down 2.1% (17.1 Mt) from 2022.

Global coarse grain production is pegged at 1,511Mt in 2023, 3.6% above the outturn in 2022. A significant upward revision was made recently to the maize forecast for the United States of America based on higher yields, offsetting cuts to production forecasts for the European Union.

World cereal total utilization in 2023/24 is forecast at 2,813 Mt, 1.1% higher than in 2022/23. Global wheat utilization in 2023/24 is expected to reach 791.4 Mt, surpassing the estimated 2022/23 level by 1.8%

The forecast for world cereal stocks by the close of seasons in 2024 is 886.5Mt, up 2.7% above the opening level and marking a new record high. Based on the latest forecast, the global cereal stock-to-use ratio would be 30.8% in 2023/24, nearly unchanged from 30.7% in 2022/23 and indicating a comfortable supply level.

In the USA, cereal production in 2023 is forecast to exceed the 5 year average by 4.3%, driven by a large maize outturn (382.9Mt) owing to a strong upturn in plantings. In Canada, cereal production in 2023 is expected to decline 7% against the 5 year average, as the main spring wheat crop suffered from drought conditions and, as a result, yields are forecast at low levels. Cereal production in the European Union in 2023 is forecast to increase marginally (up 1.2%) compared to the previous year, attributed to a larger coarse grains output.

Source: FAO

Total cereal production in the South and Central Americas is forecast at an all-time high of 300.2Mt in 2023. This large output principally reflects a record maize outturn in Brazil, underpinned by a substantial increase in maize plantings, as well as high yields. The bumper Brazilian output more than compensated for below-average harvests elsewhere in South America due to prolonged dry spells, especially in Argentina where drought conditions are expected to result in a 15% decrease in cereal production compared to the 5 year average.

Looking ahead to 2024

UK wheat production is estimated at 14.05 Mt for the 2023 harvest, a 10% reduction on the 15.54 Mt produced in 2022. This deficit in output outweighs the heavier carry-in stocks (up 9%), increased imports (up 6%) and domestic consumption (up 3%) to leave the year end surplus reduced by 54% compared to 2022. Reduced availability applies to UK barley too (down 4% year on year) following a 5% decline in production (6.98Mt harvest 2023) with poor spring barley yields outweighing a rise in total planted area.

Demand from brewing is lacklustre but demand from distilling continues to rise as capacity increases. Maize imports are expected to rise in 2024 for increased usage in animal feed production. The 2024 early bird planting survey for Scotland indicates a switch away from wheat and oilseed rape (down 7% and 19% respectively) due in part to the wet autumn while correspondingly winter barley and spring barley are anticipated to increase in area (19% and 6% respectively).

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service