Agribusiness News January 2024 – Milk

1 January 20242023 Review: The milk price crash and falling milk volumes

- Milk volumes tanked in the second half of 2023.

- Falling prices of butter, cream, SMP and cheddar drove down milk prices for much of 2023 and have only recently started to recover.

- Milk price has been below the cost of production for much of the year.

- Industry analysts suggest milk prices have reached the bottom and should start to improve in Q1 and 2 of 2024.

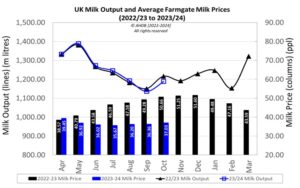

January 2023 started on a high for dairy farmers, with the Defra average farm-gate milk price being 49.48ppl. However, in the first half of the year, the milk price dropped like a stone, falling to 36.02ppl by June. As we approach the end of 2023, milk prices are about 15ppl less than 12 months ago.

The fall in milk price was largely attributed to continued market pressures, with a reduction in consumer demand and milk supply above forecasted levels. Retail price inflation reduced customer spending on dairy products and more consumers moved away from branded products to cheaper supermarket own-label products.

As the spring flush approached, buyers were holding off, awaiting lower prices, and sellers were unwilling to discount price much further due to current high manufacturing costs. A wet summer curtailed milk production in some areas and given the relatively high cost of inputs in relation to the milk price, farmers were not incentivised to push for production. As a result, since September, GB milk volumes have been well below last year, with September and October volumes 1.3% and 2.7% less respectively.

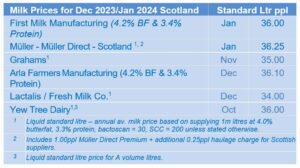

UK wholesale prices for butter, cream and SMP have been improving since August and and commodity prices in the EU have also continued to rise since the autumn, especially in butter and whey. Unfortunately there is usually around a three month lag in effect on the milk price and farmers are just now starting to see some stability, with no price drops announced for December from the main Scottish milk buyers. For retailer aligned contracts, small price reductions have been seen between 0.05ppl and 0.75ppl. The first sign of a milk price improvement came from Arla announcing a one eurocent increase for December 2023 on the back of greater retail demand, a recovery in the commodity markets and global milk production continuing to ease in the main milk producing regions.

For 2023, the average cost of production was estimated at just over 37ppl, well below the Defra average farm-gate milk price from May to October.

AHDB estimates that GB production for the 2023/24 milk year will be 12.22 billion litres, 1.3% less than the previous year. The reduction is largely attributed to farmers cutting back due to the relatively high cost of production in relation to their milk price. It has been a similar situation globally with production back in the US and EU in the second half of the year.

2024 Dairy Outlook

Milk prices are predicted to pick up in early 2024. Given the recent positive movements in the Milk Market Value indicator (up 2.2ppl for November), farm-gate milk prices are expected to increase by around 1ppl throughout January and February. Müller and First Milk have so far announced a price hold for January. Other processors south of the border are raising their January price, including some cheesemakers who have had a challenging cheddar market over the last year, with mature cheddar in storage which was made when milk was around 50ppl. However, the extent of milk price increases in the early part of 2024 will be highly dependent on global demand.

Rabobank experts predict that dairy product prices will continue to improve next year, with minimal growth (0.3%) predicted in milk supply from the main exporting regions. However, there remains uncertainty around changes in consumer demand and volatility is expected to continue into 2024. Some of the risks to recovery of milk prices above the cost of production are geopolitical instability, unpredictable energy markets and global economic conditions related to high dairy inflation, the on-going cost of living crisis and consumer confidence in dairy.

Lorna Macpherson, lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service