Agribusiness News January 2024 – Sheep

1 January 2024Summary of 2023

The last year has seen a vast amount of change in the global sheep sector, including:

- The free trade agreement between Australia and the UK commencing at the end of May;

- The European flock declining and in turn the European price increasing (supply:demand);

- The Australian flock growing and the price falling substantially.

Within the UK we have seen our exports to other countries increase throughout the year. We have also seen lamb sales in the backend ahead of the previous years. Lambs have been exposed to a high worm challenge in 2023, due to the wet and warm summer and autumn months, we have seen high feed costs, flocks’ productivity recovering from the drought in 2022, and finally we have seen the worlds loneliest sheep being rescued!

Prime deadweight sales have shown favourable, starting the year slowly at an SQQ of 534.90/kg (~£112/lamb) and rising up to the top for the year at 742.9p/kg (~£156/lamb) for the week ending 20th May. Since this point the trade reduced to a low similar to the start of the year at 553.1p/kg at the end of September. However, from this point it has gradually improved week on week.

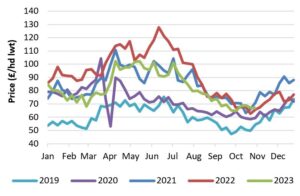

Cull sales have shown very similar to those recorded in 2021. We have seen typical peaks in trade around religious festivals e.g., Ramadan.

Scotland Cull Ewe Price

Source: AHDB

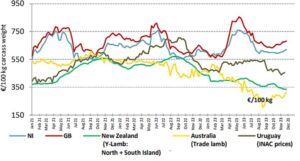

The Australian flock has expanded, and with this increased supply their price point has reduced substantially over the last year, starting 2023 at around €4.50/kg and falling to €2.80/kg in September.

World Market Prices (lamb carcasses)

What will 2024 bring?

Global demand for protein and sheep meat is expected to increase into 2024, with a rising population and a recovering economy. As African Swine Fever continues to sweep through the global herd, demand for proteins such as lamb in China and Asia is set to grow.

The Middle East is on their journey to recovery from COVID, tourism coupled with population growth and protein consumption is all rising. Woodhead Brothers, Turriff now has accreditation to supply this market, which will offer great opportunities as we progress in to 2024. Currently this is targeted at the premium, food service market. Allowing little competition for the cheaper Australian sheep meat.

Demand from the US is set to be reduced, due to decreasing disposable income and a poor economic outlook in the country. The concern here is, with a decrease in the US market, more Australian lamb could make its way to the UK and Europe, affecting our markets significantly. As a reminder, the free trade agreement commenced in May 2023, within 10 years, tariffs on all sheep meat and agricultural goods will be eliminated.

With the European sheep flock set to decline further in 2024, we have a strong export outlook. However, there are great changes coming into the future for UK sheep farming. One of the largest challenges, will be changing land use, as the market for carbon capture and offsetting grows. We may see the national flock further reduce as more productive sheep land is used for these non-agricultural land uses.

The drive for greater efficiency and reduced carbon systems, will also grow as we progress into the new year, with shoppers set to make more environmental choices on their weekly shop. For the sheep industry this could be a huge opportunity for both sheep meat and wool!

Kirsten Williams, 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service