Agribusiness News July 2022: Cereals and Oilseeds

30 June 2022Demand destruction, harvest pressure

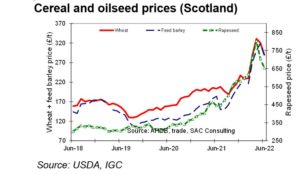

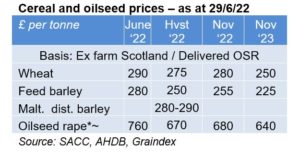

UK grain prices have dropped significantly in the last month with Nov ’22 LIFFE wheat futures down 11% / £35.25/t to £282.50/t in the last month. On a global basis a number of factors have been at play:

- Harvest pressure as the combines roll in large exporters – and no major new crop losses have been reported recently – though heat in the US is a current worry.

- The withdrawal of buyers at high prices – developing countries in particular may need the grain but they just can’t afford the recent high prices. The upside is that as soon as prices dip, there is a spate of buying interest, putting a floor in the market.

- Demand destruction – loss of demand in livestock and industrial sectors as margins weaken. Livestock margins are suffering as people reduce meat purchased. Ethanol- the US uses over 136mt of maize for ethanol, but with mid-term elections coming Joe Biden won’t cut ethanol mandates to keep votes in the Midwest.

- Some hope that ways will be found to export Ukraine cereals – whether through a lifting of the Black See blockade or better land routes, though this is unlikely to make much difference as crop areas are down already

Good prospects for UK and Scottish harvest

Growing conditions have generally been pretty favourable across Scotland and the UK. It has been quite dry in many areas and there may be pockets where yields have been affected but most areas have continued to receive light, if erratic, rainfall.

In their latest estimate (May) Coceral place UK cereal production in 2022 is up 5% – 1.14mt higher at 23.84mt vs 22.70mt, with the gains mainly in wheat, with barley output down. If achieved, this will make little difference to the UK’s net position as a moderate net cereal importer.

In Scotland, winter and spring cereal areas are expected to be little changed in 2022 meaning that the actual level of yield and quality achieved for both feed and malting markets will be an important driver of local prices.

Ukraine in numbers

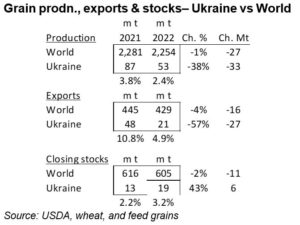

Based on the latest estimates from USDA (June WASDE), the table below shows the disruption to both production and exports of grains from Ukraine relative to the world situation. This shows that the loss of both grain production and exports from Ukraine make up more than the expected fall in world production and trade. So yes, the war in Ukraine has a huge part to play in the current supply and demand situation. And the world has not been able to make good the losses in Ukraine from other regions.

Where next? – production of grains in Ukraine is already forecast 38% lower in 2022 so that’s 33mt of grain that have gone from the world balance sheet. If export volumes can be increased from Ukraine, whether by sea, road, or rail then there is potential for a small increase in supply, but this will only make limited difference as stocks are just 6mt higher in 2022 vs 2021.

julian.bell@sac.co.uk, 07795 302 264

For more up to date market info, see the latest edition of Agribusiness News

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service