Agribusiness News June 2023 – Milk

2 June 2023Milk prices continue to fall for June

- Milk volumes are now past their peak and falling, however, further price cuts for June have been announced.

- Farm-gate milk prices are now in the region of between 35-40ppl from the main Scottish milk buyers, depending on the type of supply contract, with supermarket aligned contract faring better and over 40ppl.

Milk production data

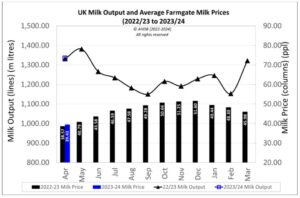

Milk production data shows that UK milk output for April 2023 was 1,335.4m litres – an increase of around 3.5m litres on a year-on-year basis (+0.3%) and 1.1% higher than March 2023.

April was a cold, wet month with UK milk production running below AHDB forecasted volumes. The spring flush, where production peaked at the end of the first week in May at 45.22m litres (7-day rolling average), was very similar to the peak in the previous year, with an average daily volume of 45.3m litres.

Farmgate prices: June 2023

The UK average milk price for April 2023 was 39.43ppl – down 4.15ppl from March 2023 but 2.2% higher than April 2022. The main Scottish milk buyers have either reduced their price for June or held at the May price.

Dairy commodities and market indicators

There was very little movement in UK wholesale prices of dairy commodities from April going into May, with prices now back significantly on where they were six months ago. Trade was fairly quiet on the back of buyers holding off purchasing, keen to see what milk volumes would do with the approaching spring flush, and sellers not looking to generate sizable sales, waiting to see how supplies might be affected by the extent of peak milk production.

The milk market indicators AMPE and MCVE showed little change for the month of May. With AMPE representing the processors’ factory-gate value of one litre of milk to produce butter and skim milk powder, the May value is still well below the lowest liquid standard litre price for June in Scotland.

The latest Global Dairy Trade (GDT) auction held on 16th May returned a negative price index, with the GDT price index down on average 0.9% to $3,488/t from the previous auction two weeks ago. The previous two auctions resulted in positive price movements.

Looking forward

According to AHDB’s most recent survey of milk buyers, there were 7,500 dairy farmers in GB as of April 2023. Despite this being 380 fewer than in April 2022, milk production has not fallen, with the high milk prices in the latter half of 2022 stimulating production growth which has been maintained over the winter months.

Recent announcements by supermarkets to reduce the cost of milk and other dairy products, combined with post-peak declining volumes, mean that supply and demand may come more into balance, adding some stability to the markets. For farmers, cost of production will slowly start to decline as feed prices have been falling, and looking forward, the prospects of lower energy and fertiliser prices mean that the economics of milk production should be more favourable as we head into the autumn and winter period.

Going by the futures markets, milk prices are looking like they will settle around the mid-thirties so there is perhaps some further reductions in price to come yet. Along with the strong beef prices, there is little incentive at the moment for farmers to push for milk volumes. Weather events will likely play a part, especially if last year’s drought conditions are repeated, reducing output, which may help prevent milk prices falling further.

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service