Agribusiness News March 2023 – Cereals and Oilseeds

28 February 2023Rising world exports pressure prices

World wheat markets are seeing short-term downward price pressure from the large Russian export surplus, undercutting EU wheat exports into North Africa. At the same time, Brazil is harvesting record soya and maize crops and this is pressuring world feed grain and oilseeds values lower. Soya production in Brazil/Argentina/Paraguay in 2022/23 is now seen at 204mt, compared to 177.6mt last year, despite the drought in Argentina.

Looking to new crop, spring plantings are just beginning but winter crops are suffering from dry conditions in Europe and winter wheat is suffering possible winter damage in the US. The concern in Europe is that the dry spell is forecast to continue into April and soil moisture levels are already low in many areas. This means crop potential will be linked to regular rainfall during the growing season.

Will the US see big crops in 2023?

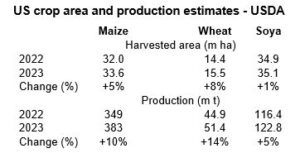

The USDA released their first estimates of US crop areas, production and use for 2023 harvest. The trend is for higher cropped area led by wheat and maize with soya broadly stable. Better yields are also seen assuming a return to average weather conditions – always a big IF at this early stage.

Maize sowings are expected to rise despite high fuel and fertiliser costs. US (and global) interest rates are also rising; now at 4-5% versus 0.5% just 1 year ago. This makes input intensive crops such as maize less attractive than soyabeans. Also, high interest rates are a disincentive to store grain increasing harvest price pressure. US soyabeans are expected to face growing competition from a much larger South American soya crop.

The USDA also estimated a fall in maize and other crop prices. This all depends on weather and crop yields as projected. Based on this, USDA project US ex-farm maize prices falling £40/t from £223/t in 2022/23 to £183/t in 2023/24. This is almost in-line with current UK wheat futures prices which at present are set to fall from £254/t to £234/t in 2023/24.

- Increased US grain and soya production and rising exports on world markets projected.

- US crop production remains subject to unknown weather conditions.

- High input prices and rising interest rates continue to dampen market incentives for maize in particular.

UK late season market factors

UK wheat prices have ended around £5/t down on a month ago having fluctuated widely in recent weeks. Export demand remains strong. There are some local UK factors that suggest a risk of weakness for UK grain prices towards the season’s end though these local factors could be over-ridden at any time by wider global weather and political events:

- UK wheat export pace remains below that needed to clear the wheat surplus – risk of stock overhang at year-end.

- Domestic feed barley demand drops in late spring if grass growth resumes on time.

On the upside, the dry conditions across the south and east of England are a growing risk factor for cereal yields with the forecast for the dry spell to extend into April. At particular risk is the large area of spring malting barley grown in north Norfolk on light soil that is important for the UK’s overall malting supply and demand balance and ultimately prices in Scotland too.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service