Agribusiness News May 2023 – Sheep

1 May 2023Lamb - The Golden Nugget For April

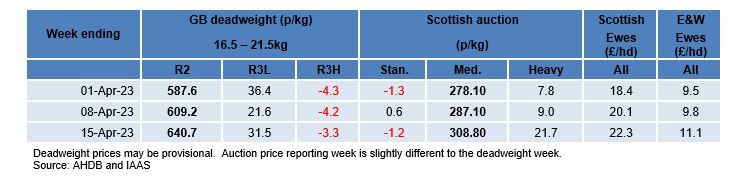

In April, we witnessed prime lamb rise ~£1.50/kg DW, with the heightened demand driven by Ramadan, Eid-al-Fitr and Easter.

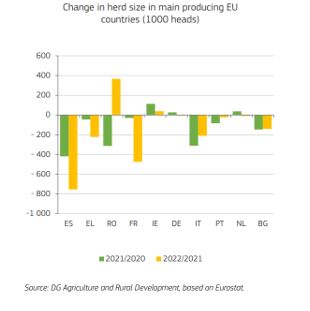

Various industry forecasts, predict the UK lamb price to remain high due to the declining flock in Europe combined with the high European lamb price. It is estimated that the European sheep flock has decreased by 1.5 million head, with production reduced by 1.2%. The largest flock decreases are seen in Spain (ES) and France (FR) as demonstrated in the graph below. This shows the third consecutive year that the European flock has declined by over 1 million head of sheep. However, flock growth has been seen in Romania (RO) and Ireland (IE).

Lamb Value

The European value of lamb is high with France at €8.44/kg DW (15/04/23) and Spain at €7.25/kg DW (15/04/23). However, the Irish price is lower at €7.05/kg DW (15/04/23). With this competitive Irish price and a good supply of lamb, their exports have risen substantially so far this year, with 20% year on year rises of exports in February and March. As an equivalent, the GB lamb price for the same week showed as €6.88/kg DW, while the NZ lamb was €4.24/kg DW.

Beef and Lamb NZ have updated their 2022-2023 outlook recently. NZ has had a poor trading season so far, with low slaughter prices due to high inflation impacting the demand of sheep meat. The main market for the NZ product is China, where 85% of their mutton is exported to, but due to Covid reinfections, the demand is currently low. NZ farmers have also had to deal with extreme weather events such as drought and cyclone Gabrielle plus inflated costs, poor returns, and a growing environmental agenda. With a decreasing national flock, the end price for sheep meat is expected to improve. In NZ, it is estimated 175,000 hectares of farmland has been sold for forestry in the last 5 years.

With tight global supplies of sheep meat, a favourable currency and a growing export market following the disruption of Brexit and Covid, the short term future looks bright for the UK sheep industry. The price difference between the European and UK lamb is what makes or breaks the export trade, with recent weeks seeing very little exported. With religious festivals now past, the price will drop slightly, making our product more attractive to the European buyer.

The currency to keep an eye on is the Euro:US dollar, with the US dollar currently very strong. The dollar drives the export market; a devaluation of the euro against the US dollar could mean an increase in purchasing agricultural inputs and in turn deepen inflation.

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service