Agribusiness News November 2023 – Cereals

1 November 2023Hard to find bullish sentiment

Recently, traders in the agricultural commodity markets have been looking to supportive fundamentals. These have included weather conditions in South America, increased demand for U.S. exports, surging crush and ethanol demand, growing Chinese interest, a potential resurgence of wheat imports in India, and reduced Russian exports which could boost export demand in Europe. Additionally, there were macroeconomic factors such as declining EU and UK currencies and the possibility of rising crude oil prices due to Middle East tensions.

The U.S. markets were particularly active, with wheat, maize and soyabean all testing resistance levels. However, all these attempts failed, and the markets then began testing recent support levels to the downside. Similarly, in Europe, the LIFFE wheat May24 contract couldn’t sustain itself above £200/t, and the MATIF wheat Dec23 contract struggled to break the long-term €240/t resistance.

All of this meant the markets experienced a recurring pattern of rebounding briefly only to face subsequent price drops again. The abundance of cheap Russian wheat supplies, (Russia has about one third of the world’s supply of wheat), continues to exert downward pressure on markets. By way of example, Russian Black Sea wheat (FOB) has been trading at a 15% discount to EU wheat available out of Black Sea ports.

This reduced export demand for European-origin wheat therefore, coupled with a lack of tenders from major importers, continues to weigh on prices. UK wheat into Spain and Ireland, is facing fierce competition from Germany and Denmark. European markets are also following the global trend, facing a €7 decrease week on week in the most active contracts. Furthermore, recent rainfall in Australia and Argentina is easing concerns in these countries, which are expected to contribute significantly to global wheat exports in the 2023/24 marketing year.

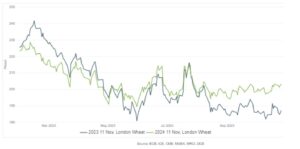

AHDB market data, is not surprisingly, illustrating a bearish longer-term outlook for grains, in part, attributed to the global oversupply situation, especially in maize markets, with a near-record U.S. maize crop now entering the market, and South America expected to fill the seasonal gap from early 2024. At time of writing, Nov ‘24 London feed wheat futures are priced at £203.20/t (Fig 1)

Fig 1. Nov 23 and Nov 24 London Feed Wheat Futures Jan 23-Oct 23

The geopolitical tensions in the Black Sea appeared to have eased, contributing to the bearish sentiment. However, any escalation in these tensions could potentially add a risk premium to wheat prices. The Middle East situation, while not directly related to grain fundamentals, has implications for energy markets. Brent crude oil futures, for example, only recently increasing 2% because of conflict concerns.

In the UK, feed barley has seen demand rise considering its competitiveness versus wheat and maize in feed rations. Malting barley markets remain quiet and the large carryover of stocks seen into this year is unlikely to be repeated in 2024 given the low yields seen across much of Europe. With storm Babet more than likely to push more area into spring cropping, and inevitably more spring barley planted, a reduced or negligible carry-over can only be price-supportive for 2024’s harvest.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service