Agribusiness News November 2023 – Milk

1 November 2023Milk volumes are declining, dairy markets are more positive but farmgate prices slow to respond

- Milk volumes are well below last year’s levels at this time.

- Dairy commodity prices continue to increase, both domestically and in the GDT auction.

Milk production data

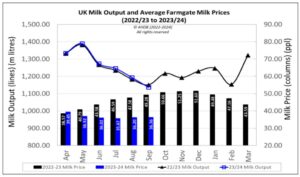

The latest milk production data from AHDB shows that GB milk output for September was 962m litres, 3.4% less than the previous month and 1.4% below September 2022. Daily deliveries were 32.4m litres (w/e 21st October), 0.2% above the previous week but 3.0% less than the same week in 2022. UK production for September was 1,136m litres, 4.5% less than August, as shown below.

Farmgate prices: November 2023

First Milk and Müller have reduced their November milk price by 0.85ppl and 0.5ppl respectively with others likely holding (but not announced at time of writing). The Defra average UK milk price for September 2023 was 36.36ppl, up 0.16ppl from August but 26% lower than September 2022.

Dairy commodities & market indicators

All dairy commodity products traded between 25th September and 22nd October showed a positive price uplift from the previous month. While mild cheddar was only up 1%, butter, cream and SMP were up by 10%, 9% and 19% respectively. These increases are attributed to reducing milk supply in the EU, helping bolster the demand for cream exports. The increase in SMP has been driven by positive movements in the two most recent GDT auctions and more product being exported to the Middle East and southeast Asia. As a result, AMPE has increased by 5.71ppl for October, with MCVE only up 1.19ppl on the back of the marginal increase in mild cheddar price.

MMV or the Milk Market Value (as reported by AHDB Dairy) indicates the average market value of one litre of milk based on how it is typically utilised in the UK. Changes in MMV are usually closely correlated with movements in the farmgate milk price in three months’ time. MMV for October was 34.57ppl, up from 32.48ppl last month, and this was the first significant positive movement in MMV in over a year.

The two GDT auctions held in October (3rd and 17th) both saw increases in the average price of all products sold. The latest average was $3,202/t (up 4.3% from the previous auction) and this is the 4th price rise in a row, sparking more optimism in the dairy markets.

Looking forward/global outlook

Currently, milk production in the main exporting regions (EU, USA and NZ) is declining and for the last six months of 2023, output is forecasted to be fairly static (-0.2 to 0% growth). Peak production in New Zealand has suffered from El Nino’s dry weather effects, impacting grass growth. The recent positive GDT auctions and EU commodity markets should hopefully mean the last of milk price cuts for now. However, since commodities are still only at a price comparable to the current farmgate milk price, they will need to move significantly higher before processors are likely to increase the price paid to their farmers.

Increase in levy rates

There are proposals to increase AHDB levy rates for the 2024/25 financial year. The dairy levy was last set over 20 years ago and looks set to rise by 33% from 0.06ppl to 0.08ppl. Final recommendations will be put to AHDB’s board by sector councils before the proposals are put forward to Government and devolved administrations before the end of the year. The increase will go towards improving delivery of services, including marketing and identifying new export opportunities, continuing their independent research and strategic farm networks.

Lorna MacPherson; lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service