Agribusiness News October 2022 – Sheep

30 September 2022Mini budget and currency exchange

The Chancellor of the Exchequer Kwasi Kwarteng announced the UK mini budget on the 23rd of September, which included various economic policies, which has since made an impact on the value of the pound. At the time of writing (26th September) the pound is at a record low against the dollar at £1 = $1.08 (the same day we saw this as low as £1 = $1.035). When the pound is low, the cost of inputs from abroad tends to be higher, this will include fuel, fertiliser and some feeds e.g. soya.

With inflation over 10%, the highest it has been for 14 years, The Bank of England has increased their base rate to 2.25% (23/09/22). Often when an interest rate of any given currency increases, foreign investors find it very attractive to invest in, which in turn strengthens the value. But given the potential financial crisis that the UK is progressing towards this affect hasn’t happened, with the euro exchange currently standing at €1 = £0.89 (26/09/22).

But what does this mean for the lamb market?

The pound is low against other currencies, which makes our product attractive to foreign buyers and most importantly our European customers. Combined with this our lamb price is low compared to European countries. Figures released from BordBia (the Irish food board) show the week ending 17/09/22 French lamb at €8.00/kg DW, Spanish lamb at €7.19/kg DW and Irish lamb at €6.13/kg DW, compared to UK lamb at €6.03/kg DW. Kiwi lamb isn’t far behind us at €5.78/kg DW, while the Australian product is far lower at €5.11/kg DW. The French lamb is currently just under a €2/kg premium to the UK lamb, which should sustain our export market while the currency responds to the economic policies.

Cost to finish lambs v selling store

Following the dry conditions for half of Scotland during the summer, there are some producers with heavy lambs, a poor finish. These lambs may require concentrate feeding to finish them, affecting the overall profitability of the system. The alternative is to sell lambs store, eliminating the requirement to feed concentrates and prioritise the grass for the breeding stock.

The market is varied for short-, medium- and long-keep lambs. With a mixed class forward for sale between lowland, hill and those lambs affected with a lack of grass through the summer. Hill long keep lambs are currently trading between £25-55/head. We may see more of these store lambs coming forward depending on the pressure of cash flow and grazing availability.

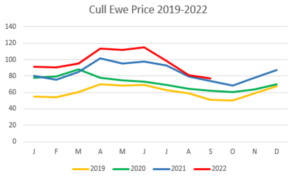

Lean grazing cull ewes coming forward are increasing as producers are selling feeders prior to breeding as well as hill weaning progressing. The market for these will be interesting to watch and will vastly depend on how finishers view future cull ewe prices which tend to rise towards the turn of the year.

Breeding tup sales are progressing well across the country, with good averages being achieved at most centres. Many producers are looking at their systems, how to reduce costs and labour, with many looking to reduce the time the tup is in for this year, and to maximise the nutrition gained from forage.

kirsten.williams@sac.co.uk; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service