Agribusiness News October 2023 – Cereals

29 September 2023Harvest Roundup

With harvest all but concluded in Scotland, the early consensus is that wheat has had the better year of all the crops and whilst adrift of 2022 harvest output, yields have been respectable-to-good. There are positive markers too against specific weights and Hagbergs but proteins have been reported as lower, although sufficient to satisfy the trade’s lower-grade milling requirements. Winter barley has also achieved the standards required in what has been described as an average-to-good season. The Spring barley yield average has declined as harvest progressed with notable regional differences on quality; Northern Scotland samples appear to have less high-nitrogen issues compared to Southern Scotland, although the reverse holds true for skinning levels. Oilseed rape yields have been reported as average at best and oil content is lower than last season

At UK level, wheat harvest production estimates currently lie in the region of 14Mt, down1.5Mt on last year. Despite the rise in opening carryover stocks, the projected drop in production will lead to contracted domestic availability. While there may be a knock-on effect for import requirements for high protein milling wheats, the demand from the livestock sector is likely to continue to be subdued through this year and into next. Pertinent to Scotland, the distilling sector requirement remains strong as increasing processing capacity continues to come online.

On-farm audit process

Cereals assurance body Scottish Quality Crops is introducing a new rolling certification model effective from 1st October this year as part of an improved auditing process. The change, which moves to a ‘product specific’ certification, will provide rolling certification over 12 months and so allow grain passports to be issued to growers earlier in the year and well ahead of harvest. All growers will still be required to have an annual assessment which is carried out by Food Integrity Assurance on behalf of SQC.

Market movements

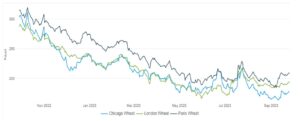

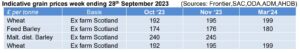

UK feed wheat futures for Nov-23 closed at £192.75/t (Nov-24 futures closing at £203.00/t) as at 27/9/23. Twelve months ago, Nov ‘23 futures stood at £287.35, a 33% decline in value therefore over the year. Fig 1 overleaf.

Global markets are currently supported to an extent by concerns around wheat production out of southern hemisphere heavyweights, notably Australia and Argentina. Overriding this however, is the continuing downward price pressure from competitive Black Sea supplies, although a weakening £ against the US dollar has recently softened falls here. Longer term, both quantity and quality of global wheat supply will continue to be front and centre and at a time when global maize supply looks to be increasing this year, that in itself, is bringing a bearish sentiment to both UK wheat and barley values.

European Union

On 18th September, EU Commissioner, Janusz Wojceichowski alluded to regulatory changes with the planned introduction of ‘Third country’ certification and checks, due to start in January 2024. Notwithstanding his comment at the time, that the UK is still ‘the most important destination for our exports’, appears somewhat counterintuitive.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service