Agribusiness News October 2023 – Milk

29 September 2023Positivity in dairy markets but will milk prices respond?

- Milk volumes are now past the trough and will continue to rise until the flush.

- Dairy commodities are showing positive movements in price, both domestically and in the GDT auction.

Milk production data

The latest milk production data from AHDB shows that GB milk output for August 2023 was 997m litres, 2.2% less than the previous month and 0.8% more than August 2022 volume. Daily deliveries in August were 32.2m litres as of the week ending 9th September, 0.1% above the previous week and 0.8% (or +0.27m litres a day) more than the same week in 2022. UK production for August was 1,193 litres as shown below – down 4.2% on July 23 but 1% higher than August 2022.

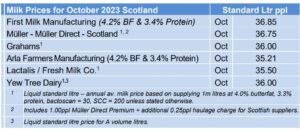

Farmgate prices: October 2023

While the main Scottish milk buyers have all held their milk price for October, there have been further cuts by processors south of the border.

The Defra average UK milk price for August 2023 was 36.11ppl – up 0.09ppl from June but 23% lower than July 2022 (August price not announced at time of writing).

Grass growth

Grass growth rates are still just above the 4-year average at 58.4kg DM/ha as of the w/b 18th September (GrassCheckGB). Average grass crude protein content across dairy, beef and sheep farms is still very good at 20.3%, with an ME of 10.8MJ/kg DM.

A 650kg spring-calving dairy cow is predicted to eat 10.5kg DM of grass in October, and at 10.8ME, this will support just M+7.2 litres of milk from grass alone.

On a wet day, it is likely that grass is supporting little more than maintenance so make sure you are taking into account weather conditions and the dry matter content of the grass if cows are still outside grazing.

Dairy commodities & market indicators

There was little movement in the average price of dairy commodity products traded between 28th August and 22nd September. However, price movements for butter, cream and SMP were slightly positive, up 2%, 1% and 1% respectively compared to the previous month.

Increased export demand for butter due to lower EU stocks helped bolster the butter price. Only mild cheddar fell by 2%, impacting the market indicator MCVE which dropped 0.75ppl from August, while the positive price movements in butter and SMP results in AMPE increasing by 0.21ppl.

The latest GDT auction (19th September) rose by 4.6% from the previous event to an average of $2,957/t. This is the second rise this month, ending a spell of negative price movements since mid-May, adding some much-needed positive sentiment to the markets.

Skim milk powder was up 5.4% to $2,400/t and butter increased by 3.8% to $4,723/t.

Looking forward/global outlook

According to Rabobank (bankers and dairy analysts), global milk supply and demand remains in balance, with slowing global output and luke-warm demand growth in most of the main milk producing regions.

Supplies have been reducing in most regions, including the US, EU, and New Zealand on the back of lower milk prices and Rabobank have reduced their milk production growth forecast for 2023 from 0.5% to 0.3%, compared to 2022 volumes.

Looking forward into next year, global growth is predicted at just 0.4%, well below the yearly average increase of 1.6% seen from 2010 to 2020.

Lorna MacPherson, lorna.macpherson@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service