Agribusiness News September 2022 – Management Matters

1 September 2022New Zealand Free Trade Agreement

While the Total UK imports (goods and service) from New Zealand (~ £943 million) decreased by 5.1% or £51 million in the year to the end of March 2022 compared to the previous year and the Total UK exports to New Zealand (~£1.6 billion) increased by 30.5% or £374 million compared to the previous year; the Scottish Government has raised concerns that the UK’s Free Trade Agreement with New Zealand will allow for much higher quantities of produce to come into the UK tariff-free, leaving “a lack of a level playing field between Scottish and New Zealand farmers.

While New Zealand only ranks as 65th out of all the UK’s import partners, the charts below highlights the significance difference in the type of key commodities being imported and exported:

Of the total imports and exports, in the year to end March 2022, Scotland exported ~ £90 million of goods and services and imported ~ £35 million. In 2021/22 Mid-Season Update Report, the UK is New Zealand’s third largest export destination for lamb and accounts for 2/3rds of the total sheep meat imports.

While the June 2021 Edition of ABN raised concerns with regards the levelness of the trading playing field for British livestock farmers with regards the Australian Trade deal; in the first year of its free trade deal with New Zealand, the UK will allow 12,000 tonnes of New Zealand beef into the UK, while the EU has agreed to only 3,333 tonnes across all 27 EU countries. By year 15, the UK Government will allow 60,000 tonnes of New Zealand beef into the UK, and after that an unlimited quantity, while the EU will cap imports at 10,000 tonnes, and will apply a 7.5% tariff. With regards sheep meat, the agreement will allow 50,000 tonnes of sheepmeat into the UK by year 15, with no limits on imports after that. In contrast, the EU agreement only allows a maximum of 38,000 tonnes across the 27 member states. In addition to which, unlike the EU agreement, the UK agreement does not recognise Geographical Indications (GI) which are of considerable importance with regards protecting the provenance of Scotch Beef & Lamb,

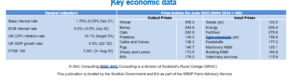

Although of further concern is that farmgate prices for New Zealand beef at ~ 562 cents per kg are up to 30% lower than Scottish prices; New Zealand is facing the same challenges as UK farmers with rising costs of production, shortage of skilled labour, and in particular, global freight congestion and surging shipping and air freight costs which are challenging exporters shipping timeframes and margins. The latter point is particularly significant for New Zealand’s chilled lamb trade. While the Scottish Government has documented its concerns in a letter to the UK Government, as yet, no response has been published.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service