Agribusiness News September 2022 – Sheep

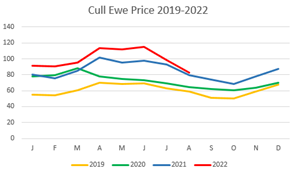

1 September 2022Cull ewe market

Recent figures from AHDB have shown that in the first six months of the year 580,000 ewes were killed in the UK, with a forecast of the 2022 total being in the region of 1.27 million head. A higher kill than we have seen in previous years, due to many producers looking at a harder cull with the escalating cost of inputs. Given that 46% of this kill occurred between January and June, with the phenomenal prices, demonstrates the demand for this product. The speed of ewes coming forward to the market will increase vastly over the coming month, with pre tupping MOTs being performed and with shortages of grazing, in some areas, these ewes will be coming forward leaner than normal, which will dent the average for these ewes. Fleshy ewes could be the commodity in the market over the coming weeks.

Breeding, Prime and Live Markets

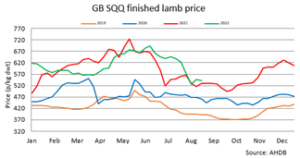

The national flock has increased by 3% largely due to positivity in the industry generated through the firm trade in 2022, as well as the ability to run a low input system. Breeding sales have shown optimism in the industry with sales trading above last years by ~£5-6/head. With potentially more lambs in the marketplace with the DEFRA 2022 lamb crop figures being revised increasing the 2022 crop from 17.5 million head to 17.9 million head.

Prime sales have seen the typical seasonal slide occur with more lambs coming forward from spring lambing flocks. The hot weather and limited grass growth has seen many leaner lambs come to market, which has knocked averages, as well as slowed down the numbers coming forward for slaughter. The increased cost of living has been shown in a drop in the domestic market for lamb, this being the most expensive protein/kg for the shopper.

Across the Water

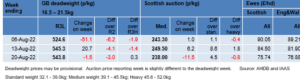

The UK deadweight SQQ closing in the week ending 13th August on a euro basis was €6.45, compared to the French product which is currently the highest price lamb in Europe at €8.02. This price differential makes the UK product very attractive to our European customers. The Spanish lamb in the same week traded at €6.77. (Data from BordBia).

The Australian trade deal is set to come into force in the Autumn of this year, however, first off we need a new prime minister, with the seat hotly contested between the former chancellor Rishi Sunak and foreign secretary Liz Truss. This trade deal will increase the volume of Australian lamb on our shelves, but with the economic pressures affecting the weekly shop, our domestic demand is going to slip. Meaning our European customers will become more important to us. The key drivers of trade include supply, demand, and the price, we currently have a good supply and a competitive price. In the same week as above (week ending 13/08/22) the Australian lamb was trading at €5.09.

It has been reported by AHDB that lamb retail has decreased 17% on the year. Customers are eating with price and convenience in mind, with legs taking a huge hit in popularity. Cuts such as stewing lamb, mince, and burgers to make easy week meals such as lamb curry, shepherd’s pie and moussaka are the most popular on the shelves.

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service