Agribusiness News September 2023 – Milk

1 September 2023Negative sentiment in dairy markets continue…..

- Milk volumes are still in the seasonal decline, but production is still slightly ahead of last year.

- Most processors are holding their milk price for September despite further drops in wholesale prices and the GDT auction.

Milk production data

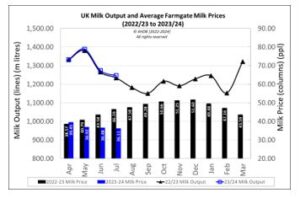

The latest milk production data shows that UK milk output for July 2023 was 1,247m litres, 2.2% less than the previous month and just 1% less than July 2022 volume. As of the week ending 19th August, daily milk deliveries were 32.09m litres, 0.3% below the previous week but 1.7% (or +0.53m litres a day) more than the same week in 2022.

Grass growth

Grass growth rates are still well above the 4-year average at 58.9kg DM/ha as of 21st August (GrassCheckGB). Average grass crude protein content across dairy, beef and sheep farms was 18.5%, with an ME of 10.5MJ/kg DM. Based on this, a 650kg spring-calving dairy cow consuming 13.5kg DM of grass will produce just M+12.6 litres from grass alone (3 litres less than in July). As always, this is just a guide and milk from grass will very much depend on your own grass quality and availability. It is worth getting fresh grass analysed to ensure grazing cows are not underfed energy at this time of year.

Farmgate prices: September 2023

The Defra average UK milk price for July 2023 was 36.11ppl – down 0.37ppl from June and 23% lower than July 2022. Milk prices are more stable, with more processors holding their August price for September, with fewer price reductions announced across the UK.

Dairy commodities & market indicators

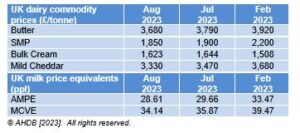

Trade in dairy commodity products has continued to be quiet over the summer holiday period, with prices of all products slightly back on last month on the back of subdued demand, lower wholesale prices in the EU and a further fall in the latest GDT auction. Both market indicators AMPE and MCVE fell for July 2023, reflecting decreases in the commodity prices and are on average 5ppl less than six months ago.

The latest GDT auction (15th August) crashed 7.4% from the previous event to an average of £$2,875/t (average price $3,289/t as of 18th July). Only cheddar returned a positive price movement, up 5.8% to $4,127/t, while whole milk powder, skim milk powder and butter fell 10.9%, 5.2% and 3% respectively.

Looking forward

Over the next 6 months, variable costs are thought to be slightly lower than previously, but volatility will remain with the biggest impacts likely to come from any extreme weather events, developments in the Ukraine war and changes to oil output which could impact on energy costs. External factors will have more impact on our dairy markets than domestic production or events, with the European market heavily influencing the UK market and EU milk production up 0.8% in the first six months of this year.

According to the Dairy Group, the prediction for the rest of the 2023/24 milk year is that continuing high costs will mean negative cash flows for many and only the top 25% of producers are likely to make a profit. Farmers are feeling the pressure, not only from the low milk price in relation to the cost of production but from trouble sourcing labour and investment costs to conform to new slurry storage regulations. A recent survey of 590 dairy farmers by the NFU, revealed that 20% were unsure if their business would continue past 2025 and 9% said they would likely stop by 2025.

lorna.macpherson@sac.co.uk, 07760 990 901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service