Agribusiness News September 2023 – Sheep

1 September 2023On the ground

With a warm and wet summer, there is plentiful grass across the countryside. This availability of grass is driving people to the store lamb rings, maintaining prices at similar levels to last year. However, the wait for the BPS loan payments and the effects of the high interest rates on borrowing money/market finance can be seen in breeding sheep and tup sales.

With the drive for cash flow, some are selling store lambs earlier than normal, these may have been third or fourth draw lambs in previous years, with a lack of bloom to them, which is creating a firm bottom end of lambs at sale.

The cull trade has dropped gradually since May, with weaning progressing well in the late lambing flocks, there are more leaner type upland and hill ewes coming forward, which has dented the high averages we have seen over the last number of months. This high supply of ewes will continue now through to October, which will continue to supress the trade.

Global trade

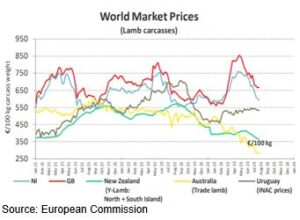

French lamb remains at the top of the pricing table with a premium (week ending 12th August) at €8.00/kg DW, compared to a very similar €8.02/kg DW for the same period last year. The Spanish product is at a reduced premium of €6.74/kg DW for the same week (was €6.77/kg DW the same period in 2022).

Looking at the other end of the table is the Australian lamb which for the week ending 12th August was trading at an incredibly low rate of €2.80/kg DW, compared to €5.09/kg DW in the same period last year!

The Australian flock has undergone flock expansion in recent years, and a large stock of lambs is now coming forward following a period of poor weather meaning a greater supply of lambs, at the same time as a drop in demand from the Chinese market.

Looking at the price differentiation between exporting countries in the above graphic illustrates how attractive in price the Australian and New Zealand lamb is, which will result in more volume being exported to the EU and the UK. Which could result in the volume exported from the UK to the EU being distorted, and our price decreasing.

Positivity!

At a time when more lamb may be coming to the EU from other sources, it is worth highlighting that the EU flock is declining, they have suffered an extraordinary hot and droughted summer, which has affected production negatively and some Spanish flocks have had losses from the sheep pox virus, all of which is speeding up the decline of the European flock. Consumption of sheep meat is not forecast to decline like other red meats, due to being favoured culturally and for religion. The European Commission have estimated that imports of sheep meat will increase by 12% this year, mainly from the UK and New Zealand.

Kirsten Williams; 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service