Milk Manager News July 2023 – Straights Update

11 July 2023Global and Domestic Cereals Outlook

Global wheat production, stocks and trade (Figure 1) are all forecast to fall in 2023/24 from their 2022/23 record high levels. Nevertheless, with significant carryover stocks from last season and nearly stagnant total utilisation, world wheat supplies are set to remain unchallenged. Global wheat markets are expected to tighten slightly in 2023/24 but should remain adequately supplied. Total wheat output in 2023 is pegged at 777 million tonnes, representing a 3.0% fall from the all-time high reached in 2022. The bulk of the foreseen decline is expected to occur in the Russian Federation and Australia, following record-high outputs in both countries in 2022, while smaller declines are anticipated in several other leading producers, including Ukraine.

Figure 1: Global production, use and stocks of wheat over the past 10 years.

Through to late June, we saw a real acceleration of grain prices to the upside driven by reports confirming downgrades to maize and spring wheat crops, primarily in the USA.

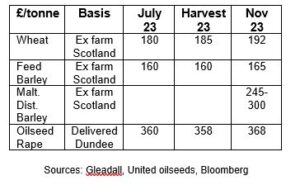

UK prices continued their rebound too, however this month so far, global grain markets have pulled back as US crop condition scores climbed on the back of widespread rains across the Midwest. UK Nov 23 wheat futures sat at £193.75/t as of 11th July, having lost much of the earlier gains in the preceding month.

Australian wheat areas are expected to dry out in July and could add to concerns over global weather hotspots. Reports that India’s production will be much lower than government estimates will be watched closely as well. If true, it could turn India, like China, into a net importer later this year, tightening the global balance sheet and becoming a new bullish factor.

The UK malting barley market has been the biggest riser of all over recent weeks, with significant premiums quoted on high-N brewing contracts. However, with the onset of an optimistic harvest in France and recent rains here, the rally may well be running out of steam. Sellers of winter barley for export continue to face aggressively priced barley of Black Sea origin.

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service