Milk Manager News March 2023 – Straights Update

10 March 2023Global News

· Despite Brazil being on track to harvest the largest soyabean crop on record, the market is dominated by drought concerns in Argentina. The forecasted soyabean harvest (by the Rosario Grain Exchange) has been cut from 37 to 34.5mT, while the Buenos Aires exchange puts it at 38mT. If the drought continues, crop condition will deteriorate. On the other hand, in Brazil the harvest is being delayed by prolonged rain and the forecasted soyabean harvest has been reduced by 2mT to 150.9mT. However, it will still be significantly higher than the 125.5mT produced in the previous year.

· Maize production estimates in Argentina have also been cut from 44.5mT to 41mT. The wet weather in Brazil has delayed the second maize crop planting as a result of a late soyabean harvest. It is thought that at least 50% of the maize crop could be drilled after the ideal planting window, reducing its potential yield. However, the country is still anticipated to harvest a record maize crop of 125mT, which is 9mT more than last year.

· The Ukraine Black Sea export agreement with Russia and the UN looks set to be renewed on the 18th of March. However, Russia has emphasised that the deal would only be renewed if their agricultural produce and fertilisers have unrestricted access to global markets.

· Looking ahead, wheat production from the major global producers and exporters could fall drastically this year. SovEcon has dropped the Russian wheat estimate from 86mT to 85.3mT, which is significantly less than the 104mT produced in 2022. Wheat production in Ukraine is also estimated to drop from 22mT to 15mT this year due to the on-going impact of the war. Australia’s wheat production is estimated to be as low as 25mT by Graincorp, which would be back significantly from the record 38 million tonnes harvested this last season. It is thought that the emerging El Niño weather phenomenon could result in the country being much drier than usual in the second half of 2023 resulting in lower yields.

UK and Scottish News

· Looking at the price charts for grain and nitrogen over the last 12 months, it reminds one of the nursery rhyme lyrics: “Jack and Jill went up the hill to fetch a pail of water, Jack fell down and broke his crown and Jill came tumbling after”. As of 7th of March wheat is back down to pre-Ukraine war levels at £224/t for Nov 2023 and nitrogen has followed. Optimists are discussing the likelihood of prices falling further and even below the £400/t mark in the coming months for ammonium nitrate; such has been the volatility in both markets.

· At the centre of all this is Russia, continuing to export the cheapest wheat in the world at a rate of some four million tonnes per month, and not just out of the Black Sea Region but from all its ports. Its Achilles heel perhaps, is the tremendous bureaucratic delay enforced upon boats both coming in and going out, which is starting to make UK wheat look a more attractive alternative source for European destinations. That’s not a bad thing, as the UK still has upward of a half million tonnes to export before July and the new crop comes in. Sterling’s weak value against the Euro is helping our export competitiveness, and our exportable surplus this year, in part, links in with the 10% reduction in home cereal usage in animal feeds over the last seven months compared to 2021/22. Barley is now below £200/t ex farm in several areas on the back of reduced domestic and export demand.

· Market traders will be aware that Europe could continue in its current dry spell into April and how soon might that impact on yields? It is fair to say there is a lot of weather developments influencing domestic markets right now; from Argentinian drought conditions to USDA reports on drought conditions in hard red wheats, to possible El Niño effects on Australia’s harvest, late in 2023.

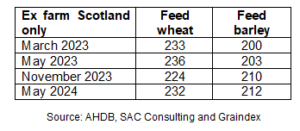

· Ex farm prices for cereals are as follows:

· While fertiliser prices have been falling significantly on the back of lower wholesale gas prices, and oil prices now down to 2021 levels, feed costs still remain high. Although cereal prices have been falling, protein remains a high cost on the back of drought in south America and soyabean meal is currently around £575/t delivered. Although feed costs should ease going into the summer, with soya predicted to drop £45/t for June, farmers will still be grappling with relatively high input costs while milk prices fall 15-20% this spring.

lorna.macpherson@sac.co.uk; 07760 990901 mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service