Milk Manager News November 2022 – Market Update

14 November 2022Market Update

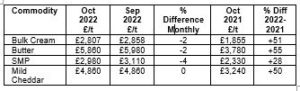

UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (1st November) resulted in a 3.9% fall in the weighted average price across all products, reaching US $3,537/t. This is the 3rd consecutive drop with only butter and cheddar returning very slight upward movements in price since the previous auction. Butter milk powder and skim milk powder (SMP) showed the biggest declines: -11.4% (to $2,973/t) and -8.5% (to $2,972/t) respectively. Full results are available at https://www.globaldairytrade.info/en/product-results/

- Closely following the trend seen in the GDT auction, domestic wholesale prices of dairy commodities fell slightly over the last month, although there was no movement in the average mild cheddar price. Falling prices were attributed to rising milk volumes both in the UK and on the continent, accompanied by reduced demand.

Source: AHDB Dairy – based on trade agreed from 26th Sep – 21st Oct 2022. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- Low butter stocks in the UK have helped minimise the fall in price, which has arisen on the back of the strong cream and spot milk prices over the trading period, diverting more milk into cream production and less butter manufacture.

- More recently, however, spot prices for cream have been falling due to a combination of increased milk volumes and some factory shutdowns meaning more product has been available. The lowest traded cream price over the last four weeks was £2,550/t.

- Declining prices on the GDT auction and negative sentiment in the marketplace contributed towards the decline in SMP prices, with buyers cautious about stocking up and waiting to see if the price falls further.

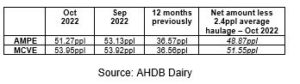

- The market indicator AMPE showed a slight drop from September but there was no movement in the MCVE indicator as a result of the very stable mild cheddar price. The butter and SMP components of the AMPE price fell by 0.61ppl and 1.19ppl respectively, with butter milk powder only falling 0.06ppl. The Milk Market Value of milk was 53.42ppl for October, back 0.35ppl from September.

- Defra put the UK average farm-gate milk price at 48.86ppl for September, up 1.78ppl from August. The volume for September was 1,157 million litres, which was 2.6% less than the previous month and only 0.2% higher than September 2021.

- For the week ending 6th November, the spot milk price showed a huge range, trading from as low as 42-53ppl delivered, with the majority trading between 44-46ppl. This is similar to the previous week with a range of 42-49ppl, where prices had eased on the back of half term holidays and plant shutdowns. Bulk cream prices fell from the previous week to as low as £2.25/kg ex works and up to £2.40/kg on the back of rising milk volumes.

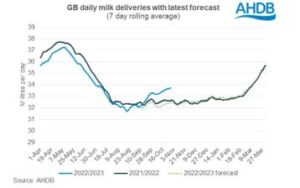

GB Milk Deliveries and Global Production

- Milk production has recovered after the drought, with deliveries now well above the same time last year and higher than forecasted levels. For the week ending 29th October, deliveries were up 0.3% on the previous week and 3.4% above the same week last year, equivalent to an extra 1.1million litres/week. If production is sustained above 2021/22 levels over the winter months, commodity markets will likely continue to see an easing of prices.

- Global production for August in the six main milk producing regions was 0.3% behind August 2021, with only Argentina and the US showing slight improvements in deliveries. Heavy rains in Australia were responsible for production being back 4.9% and New Zealand has been struggling with poor grass growth, resulting in milk deliveries being back 5.9%. Overall, global daily milk deliveries for August were 783.8 million litres.

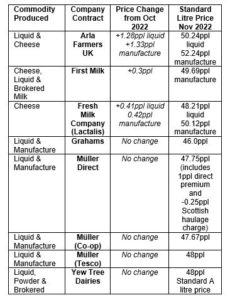

Monthly Price Movements for November 2022

Other News

- At the end of September, the Tesco Sustainable Dairy Group released their latest cost of production figures, which had fallen 0.91ppl to 42.0ppl from their June tracker review. Costs for the 12-month period between October 21 to September 22 were as follows:

- Variable costs: 23.03ppl

- Overhead costs: 13.79ppl

- Depreciation: 2.37ppl

- Total: 39.19ppl

Applying the feed, fuel and fertiliser adjustments from July to December 2022 adds an extra 2.81ppl, bringing the full cost of production up to 42ppl.

- AHDB’s recent October survey of the main milk buyers in Great Britain estimated that producer numbers were at 7850. Compared to October last year, this represents a drop of 150 producers, with only 30 less producers since April this year. It is thought that the rise in input costs having been offset by the increase in milk prices is the reason why fewer farmers have stopped dairy production compared to previous years.

- Arla has unveiled its new C.A.R.E initiative, which stands for Co-operative, Animal welfare, Renewable energy and Ecosystem. Higher standards in welfare and sustainability will be required for all farmers signing up to the C.A.R.E initiative, which will cover milk used in a wide range of their products including Cravendale, B.O.B and Big Milk. Some of the requirements of the initiative include grazing cows when weather conditions allow, having a plan to increase renewable energy sources and reduce energy consumption and supporting the natural ecosystem and biodiversity through implementing at least five various activities, such as creating habitats for wildlife.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service