Milk Manager News November 2022 – Straights Update

14 November 2022Straights Update

Global News

- Australia is currently experiencing extremely high levels of rainfall and flooding but despite this, the country could still be looking at a bumper wheat crop of 34 million tonnes. However, it is estimated that up to half of the wheat grown on the eastern grain belt, an area known for premium hard wheat, could be downgraded to animal feed. Flood water will need to recede before the extent of the damage is known. Record yields of oilseed rape are still expected. While the east of the country is seeing the worst of the wet weather, there is less oilseed rape production in this area. With harvest about to start, the impact of the weather on yields will be known shortly.

- Dry weather has also been impacting the 2023 US wheat crop, with only 28% of the crop rated good to excellent condition, the lowest percentage rating for 35 years. The drought is also affecting the cost of shipments on the Mississippi River, in that farmers in the midwest and midsouth are receiving lower cash bids for their maize and soyabeans (as much as $2/bushel less for soyabeans). The lower water level on the river means that barges cannot be fully loaded, and towboats can move fewer barges at a time, so barge companies are having to charge more for transport. The costs are being passed onto the growers and in addition, it is costing them more to transport fertiliser up the river. Grain transport tonnages were 40% lower on the Mississippi in September and October compared to recent years.

- The oilseed market is keeping a close eye on weather conditions in South America as Argentina and Brazil are currently planting their soyabean crop. Conditions are not ideal due to drought. Coupled with concerns about Brazil’s current export capabilities, saw Chicago soyabeans reach their highest level for six weeks at the beginning of November. Protests about Brazil’s recent election results have disrupted fuel deliveries and meat production, affecting deliveries of grains and oilseeds to ports. Brazil is the world’s biggest exported of soyabeans.

- Data from Ukraine’s government indicate that winter wheat plantings are 87% complete on just 3.5 million hectares, which is 57% of the normal area. At this time last year, plantings had been completed on 6.1 million hectares.

UK and Scottish News

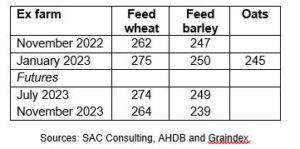

- The UK’s 2022 wheat harvest production is now estimated at 15.6 million tonnes (AHDB), which indicates the need to export the one million tonne surplus over our domestic requirements. The weak pound is incentivising prompt action on exports (UK wheat currently being the cheapest European source bar that out of Ukraine). Over 400,000 tonnes have already left the country and potentially the remaining surplus could all follow and be cleared by early new year. That would indicate a firming of prices thereafter. However, it is worth keeping an eye on UK ethanol production plans as rumours that plants may cease production in the new year would reduce price competition into the feed sector. News on Ukrainian exports remains the key price driver across markets. Russia’s recent resumption of participation in the Black Sea export corridor deal saw UK feed wheat futures fall by almost £10/t over two days. However, with Russia due to review again in two weeks’ time we could see more short-term spikes in values. Such is the uncertainty in the markets currently over future supply, we are seeing November 23 futures (£264.45/t) at parity with current ex farm prices (£262/t). At £247/t, ex-farm feed barley is currently £15/t off wheat values, and this looks to be widening to £25/t as we move into 2023 based on current forward contracts.

- Ex farm prices for cereals are as follows:

lorna.macpherson@sac.co.uk; 07760 990901

mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service