MMN January 2024 – Straights Update

12 January 2024UK Cereals Market Update and Global Impacts

Let us hope 2024 brings more stability to the markets after three straight years of significant turmoil, where the grain industry has had to deal with unique and hefty challenges from expanding military conflicts, political tensions, rising protectionism, shifting trade patterns and climate change.

Six months on from Russia pulling out of the Black Sea Grain Initiative with Ukraine, effectively blocking its seaports and bombing its grain assets, has led to accusations of Russia weaponizing food production at a time when global food insecurity is high. Even through Russia has vowed to direct its bumper harvest into import-dependent countries across Africa and Asia at discounted prices, crippling Ukraine as it has is intolerable, especially given it is one of the world’s biggest grain exporters, and at a time when world ending stocks of coarse grains are at a nine-year low.

While Russia (and Ukraine) continues to dump surplus wheat and barley on the world market at below EU values, the short-term outlook for our wheat remains bearish. Potentially a more bullish market may develop for the UK if we did indeed only produce 14 Mt of wheat in 2023 and our ethanol factories continue their preference for wheat over maize. Eventually, the realisation that we are looking at a smaller crop area and production in the EU and UK should provide some domestically driven support. UK wheat exports are negligible at the moment and our feed barley looks cheap, with much finding its way into livestock rations.

Malting barley markets are perplexing; there are excellent premiums to be had if the quality is there (around £78/t). The offtake of barley and malt has been much reduced because of falling beer sales, although distilling demand remains robust. Questions are starting to be asked about the tightening availability of physical stock through the spring and early summer, and whilst we’re expecting a larger acreage to be sown in spring 2024, it will not impact on old crop values.

The oat markets remain supported with export interest continuing. Farm-gate price levels for beans remains firm and not yet pressured domestically by more aggressive mid-protein sources.

The last two years have seen big declines for rapeseed values, with a bolstered global rapeseed supply and falling soyabean prices. 2024 will likely see a reduced lessening of values as the previously built-in war risk premiums have now largely been factored out of the pricing structure. Any significant support to the oilseed complex will only likely arise from either a major weather event in the spring or a dramatic shift in demand, for example if China started aggressively buying.

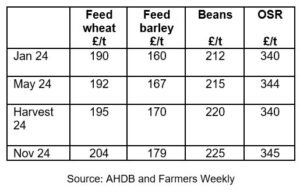

Ex farm prices for cereals and proteins are as follows:

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service