MMN November 2023 – Straights Update

10 November 2023UK Cereals Market Update and Global Impacts

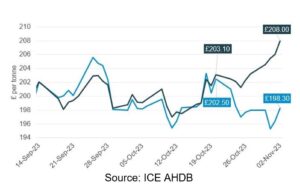

The impact of the recent storms in the UK on autumn planting programmes has started to filter through to the markets, with concern that the wheat area for harvest 2024 could fall and lead to a smaller crop and higher values. Consequently, we’ve seen Nov’ 24 feed wheat futures (new crop) rising £10/t since mid-October to currently stand at £208/t. ‘Old crop’ values however are not affected in the same way and continue to remain in the doldrums (Figure 1). This could be an incentive to lock into a proportion of winter ’24 feed supplies as a hedge against prices rising further as the year progresses.

Figure 1. Diverging values of May ’24 (old crop) and Nov ’24 (new crop) UK feed wheat

Source: ICE AHDB

Globally however, commodity markets have been looking to various fundamentals to warrant support to prices. These include weather conditions in South America, increased demand for U.S. exports, surging crush and ethanol demand, growing Chinese interest, a potential resurgence of wheat imports in India, and reduced Russian exports which could boost export demand in Europe.

The U.S. markets were particularly active, with wheat, maize and soyabean all testing resistance levels. However, all these attempts failed, and the markets then began testing recent support levels to the downside.

All of this meant the markets experienced a recurring pattern of rebounding briefly only to face subsequent price drops again. The abundance of cheap Russian wheat supplies, (Russia has about one third of the world’s supply of wheat), continues to exert downward pressure on markets. By way of example, Russian Black Sea wheat (FOB) has been trading at a 15% discount to EU wheat available out of Black Sea ports.

This reduced export demand for European-origin wheat therefore, coupled with a lack of tenders from major importers, continues to weigh on prices. UK wheat into Spain and Ireland is facing fierce competition from Germany and Denmark. European markets are also following the global trend, facing a decrease week-on-week in the most active contracts. Furthermore, recent rainfall in Australia and Argentina is easing concerns in these countries, which are expected to contribute significantly to global wheat exports in the 2023/24 marketing year.

AHDB market data is not surprisingly illustrating a bearish longer-term outlook for grains, in part attributed to the global oversupply situation, especially in maize markets, with a near-record U.S. maize crop now entering the market, and South America expected to fill the seasonal gap from early 2024.

In the UK, feed barley has seen demand rise considering its competitiveness versus wheat and maize in feed rations. Malting barley markets remain quiet, and the large carryover of stocks seen into this year is unlikely to be repeated in 2024 given the low yields seen across much of Europe. With storm Babet more than likely to push more area into spring cropping, and inevitably more spring barley planted, a reduced or negligible carry-over can only be price-supportive for 2024’s harvest.

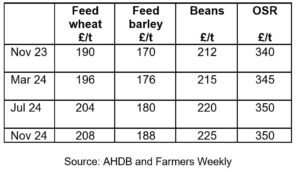

Ex farm prices for cereals and proteins are as follows:

Source: AHDB and Farmers Weekly

Other Global News

- In terms of oilseeds, market indicators point towards downward pressure on rapeseed prices, with the Australian harvest likely to meet production forecasts, although is not likely to be as much as last year’s 6.7mT harvest. Surplus is likely to enter Europe to source further demand. In addition, rapeseed exports from the Black Sea corridor continue with little disruption.

- On the other hand, supporting oilseed prices is the delay in soyabean plantings in central and northern Brazil, as well as replantings which could impact final yields. Current drought conditions and little rain in the short-term forecast means that the crop may be negatively affected during the crucial flowering and pod development phase in November and December. If the situation doesn’t not improve, global soyabean prices will likely increase, also supporting other oilseeds and their by-products.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk; 0131 603 7533

Lorna MacPherson, lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service