Milk Manager News July 2022 – Market Update

1 July 2022UK Wholesale Dairy Commodity Market

- Fonterra’s latest on-line GDT auction (5th July) resulted in a substantial fall of 4.1% in the weighted average price across all products, reaching US $4,360/t. This follows a 1.3% drop at the previous auction on the 21st of June. Of all products on offer only cheddar increased in price from the previous auction (+1.3% to $4,908/t). The biggest declines were seen in butter (-9.1% to $5,648/t) and butter milk powder (-7.6% to $4,064/t). Full results are available here

- UK dairy commodities showed a slight increase on the average price from May into June on the back of falling milk production from the seasonal peak in early May.

| Commodity | June 2022 £/T | May 2022 £/T | % Difference Monthly | Jun 2021 £/T | % Diff 2022-2021 |

|---|---|---|---|---|---|

| Bulk Cream | £2,734 | £2,579 | +6 | £1,433 | +91 |

| Butter | £6,020 | £5,890 | +2 | £3,320 | +81 |

| SMP | £3,380 | £3,310 | +2 | £2,150 | +57 |

| Mild Cheddar | £4,740 | £4,650 | +2 | £2,980 | +59 |

Source: AHDB Dairy – based on trade agreed from 23rd May – 24th Jun 2022. Note prices for butter, SMP and mild cheddar are indicative of values achieved over the reporting period for spot trade (excludes contracted prices and forward sales). Bulk cream price is a weighted average price based on agreed spot trade and volumes traded.

- The cream price showed the biggest increase, peaking at over £2,800/t near the end of the reporting period, due to restricted spot availability and lower supply compared to May.

- The butter price followed the trend in cream, although at a smaller percentage increase, and the average price of just over £6000/t is the highest since 2017.

- Price increases for mild cheddar have slowed but were still up by 2% on the month, being driven by continued demand and tight supplies.

- The market indicators AMPE and MCVE continue to climb, both up 2% from the May price. However, it should be noted that these indicators will over-estimate market returns as the increase in cost of production from the start of 2022 have not yet been taken into account. These costs will be updated for the July figures when manufacturing costs are available for quarter 1.

| June 2022 | May 2022 | 12 months previously | Net amount less 2.4ppl average haulage – Jun 2022 | |

|---|---|---|---|---|

| AMPE | 56.43ppl | 55.10ppl | 32.46ppl | 54.03ppl |

| MCVE | 54.09ppl | 53.14ppl | 33.62ppl | 51.69ppl |

Source: AHDB Dairy

- For the week ending 8th July, spot milk was trading at 56 – 58ppl delivered and bulk cream had firmed up from the previous week by around 7p/kg to £2.89 – £2.95/kg ex works.

UK Milk Deliveries and Global Production

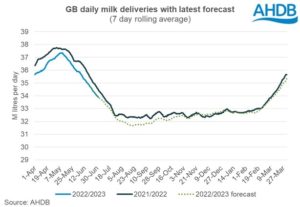

- Although GB milk production continues to decline, which is the norm for this time of year, output is very close to forecasted levels. Daily average deliveries are back 1.3% on the previous week (for the week ending 2/7/22) and are 1.7% below the same week last year, which equates to 0.57 million litres less/day.

- Production of organic milk is also down on the year and much more so than the drop in conventional milk volumes. For the period 1st April to 11th June, organic GB milk deliveries were back 7.8% compared to the same period last year, with a total of 101.64 million litres. Deliveries were on average 1.32 million litres/day for the week ending 11th June, which is 11.6% back on the same week in 2021.

- Adverse weather and high production costs are dampening global milk supplies, with production from the six key exporting regions back 0.7% in March compared to the same month in 2021. Average daily global deliveries for March were 823.7 million litres (-5.8 million litres/day). The three biggest EU producers also showed lower production: Netherlands (-2.5%), Germany (-1.4%) and France (-1.2%). Argentina was the only key region to show an increase in production for March, up 2.5% to 27.4 million litres/day, which is their highest March volume since 2015.

Monthly Price Movements for July 2022

| Commodity Produced | Company Contract | Price Change from Jun 2022 | Standard Litre Price Jul 2022 |

|---|---|---|---|

| Liquid & Cheese | Arla Farmers UK | +1.59ppl liquid +1.66ppl manufacture | 47.56ppl liquid 49.45ppl manufacture |

| Cheese, Liquid & Brokered Milk | First Milk | +1.4ppl | 43.45ppl manufacture |

| Cheese | Fresh Milk Company (Lactalis) | +3.9ppl liquid 4.04ppl manufacture | 45.4ppl liquid 47.21ppl manufacture |

| Liquid & Manufacture | Grahams | +4ppl | 44.0ppl |

| Liquid & Manufacture | Müller Direct | +4.5ppl | 45.75ppl (includes 1ppl direct premium and -0.25ppl Scottish haulage charge) |

| Liquid & Manufacture | Müller (Co-op) | +2.17ppl | 43.35ppl |

| Liquid & Manufacture | Müller (Tesco) | +3.65ppl | 46ppl |

| Liquid, Powder & Brokered | Yew Tree Dairies | +4.0ppl | 46ppl Standard A litre price |

Other News

- Freshways were the first processor to announce its aspiration to pay 50ppl for its A standard litre milk in September on the 24th of In the space of just over a week it has now confirmed that the 50ppl will be a reality from 1st September. However, Braeforge (trading as Pensworth) have gone one further and have declared 50ppl for its liquid standard litre from 1st August, with their aim of better matching market returns and being more in-line with manufacturing contracts to allow their farmer suppliers to invest in growth.

- First Milk have announced a further milk price rise of 3.05ppl from 1st August, bringing their manufacturing standard litre up to 46.5ppl.

- Defra announced that the UK farmgate milk price for May was 40.39ppl, which was 1.94ppl more than the previous month (+5%) and 34% higher than May 2021. While the volume for May was up 4.5% on April, at a total of 1,390 million litres, the volume was 1.1% less than May 2021.

- A recent survey of dairy farmers in England by the NFU has shown that 7% suggested that they were likely to stop milk production by 2024. This could potentially mean around 840 dairy farmers leaving the industry. According to the survey, the biggest concerns over the next two years were feed prices (93%), closely followed by the cost of fuel (91%), energy (89%) and fertiliser (88%).

- Heat stress has been significantly affecting livestock farmers across the globe. The Guardian reported that over 2000 cattle died in the US state of Kansas in mid-June on the back of temperatures reaching 37˚C, combined with high humidity. In parts of India temperatures have recently reached 50˚C, with one farmer in the south of the country in Anantapur reporting a drop in milk output of 30% compared to the previous month. With India producing 22% of the world’s milk, it has been suggested that rising temperatures could reduce milk output in India’s hotter regions by 25% by the year 2085.

lorna.macpherson@sac.co.uk; 07760 990901

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service