Agribusiness News August 2022 – Sector Focus: Poultry Update

3 August 2022The poultry sector has seen one of the most challenging years in a long time, facing triple crises over Avian Influenza, input costs soaring, and rising costs of living squeezing down prices and margins. While these issues have been experienced before, they have never all three coincided to this extent. These challenges come after a strong couple of years for the poultry sector, despite coronavirus and Brexit labour shortages providing new stresses to supply chains.

Avian Influenza (AI) has decimated some producers, and forced free range flocks to be housed between the 29th November 2021 and 2nd May 2022 a loss to livestock welfare as much as incomes. BFREPA estimates that 1.8m laying hens have been taken out of production due to HPAI epidemic to July 2022, accounting for 7.1% of the total UK flock.

Margins for producers are also getting tighter, with serious increases in feed prices and energy, but egg prices staying stagnant at best. Conventional feed has seen upwards of a £30/t price rise, and organic over £100/t. The Ranger notes than even some of the top producers are losing around £1 per hen in the current situation. Some producers are facing decision to leave industry or not, or at what scale to continue going forward. Prices are just now beginning to rise (summer 2022) on supermarket shelves, although this is quite a time lag for producers, and does not compensate for the increase in costs.

Producers saw an increase in farmgate egg prices through 2021, at an average of 88.0 ppd (pence per dozen), an 11%% increase from 2020. Despite rising input costs, from feed to energy, prices have so far been slow to rise in 2022, stretching producers to the max; with a cost-of-living crisis and eggs a cheap protein source, the egg sector is between a rock and a hard place.

The industry seems to being polarised in its response to tight margins, and in some cases losses, with some producers scaling up and others reconsidering the future of egg enterprises. Despite these price cuts, the number of free-range hens keeps going up, month by month. Eggs are a cheap protein source for budget-stretched consumers, so demand could be strong and some are seeing opportunity in this. In the last 12 months producers have applied for sheds accommodating 1.139m hens in England, 0.294m in Scotland, 0.132m in Wales, and 0.347m in N. Ireland – a total of 1.912m hens, and this trend is expected to continue.

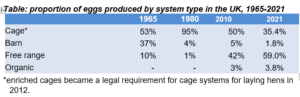

As of yet, industry figures don’t indicate that the stress on household shopping budgets is impacting the type of eggs purchased, e.g. a switch from organic to free-range choices, or free-range to

caged. Free range now accounts for 62% of the market rising 8.5% between 2020 and 2021, and organic rising 3.2%. While there was a reduction in percentage of caged eggs bought in this period there was an increase in total volume, and a further increase would be expected with egg prices likely to continue rising also.

Some retailers have been increasingly focusing on reducing emissions in their food supply chains, and both Morrisons and Waitrose have been exploring reducing soya use in poultry as a major source of emissions. However, in light of recent events in Ukraine, food security, price and self-sufficiency may become priorities over sustainability at least for the immediate term, there are win-wins for these and carbon targets.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service