Agribusiness News August 2022 – Sheep

3 August 2022Population & production long term growth

The OECD have recently published their global long term agricultural outlook (2022-2031). They predict global population increasing by 11% and red meat consumption rising by 15% by 2031. Combined with this, a predicted increase of 9% in greenhouse gas emissions, which is lower than the rate of meat production increase due to a high volume being intensive poultry (increase of 31 billion head). Sheep are forecast to increase globally by 2031 by 2.9 billion head.

It is anticipated that EU will face challenges with high domestic and environmental costs, a reduced opportunity to export product and greater competition for global markets compared to expanding sheep meat producers e.g. Asia, China, Africa, India and Pakistan. CAP support will be key here from the EU. Production in New Zealand is expected to be sustained at current levels, while Australia is expected to continue growing its national flock.

It is thought consumers will choose which meat to purchase on reasoning such as environmental, animal welfare, ethical and health concerns.

Short term outlook

While the EU have recently issued their short-term outlook. They detail the high prices of lambs being driven by high demand in the EU against a low domestic supply, with some countries reducing their flocks e.g. Greece. They have warned that high feed prices may result in lambs going forward for slaughter at lighter weights which, may distort the market.

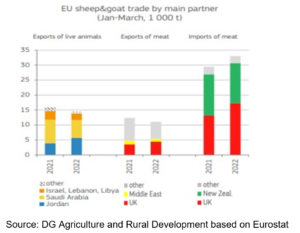

The export of live animals is forecast to decline by 8% this year following the high domestic price and continued shipping problems through the Black Sea. Sheep meat from the UK to the EU has showed great recovery post Covid-19 and Brexit, while imports from New Zealand have stayed stable. Trade frictions between the UK and the EU have been highlighted as a potential risk in the short term.

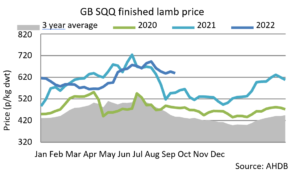

Price high but slipping

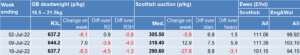

The lamb market has remained high, supported by Eid al-Adha between 9th – 13th July, since this many abattoirs and markets have reported the price dipping back in prime lambs and ewes. The week ending 16/07 the SQQ for liveweight stood at 289.9p/kg, and deadweight at 639.1p/kg.

Store lamb sales are showing the heavier better fleshed short keep lambs at a premium compared to the light lambs. With buyers capitalising \on surplus forage and good prices. The short keep lamb trade is a reflection of the price of concentrate feeding, which may marginally decline now harvest has started and barley has reduced in price a little.

kirsten.williams@sac.co.uk, 07798617293

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service