Agribusiness News August 2024 – Beef

1 August 2024Finished Price Rebounds in July

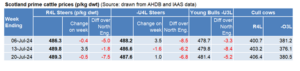

Prime cattle prices have fallen and have remained low since early March, with some processors dropping to 470p/kg/dwt, approx. 20-30p behind May and June 2023 levels.

Increased slaughterings and a growth in imports has led to increased supplies in the market, pressuring prices and contributing to a muted finished price. However, the past few weeks have seen finished prices slowly but surely improving. An earlier than expected seasonal dip in availability has resulted in a price rebound, with R4L steers reaching £4.89/kg/dwt at Scottish abattoirs;1.6% above the earlier June low.

Looking forward, numbers are tightening, and reports suggest they will contract further going into the third quarter of the year, which should help to increase finished beef prices. Of note, is the increased number of store cattle sold to buyers south of the border, which will continue to squeeze the availability of prime cattle to kill in Scotland.

The beef price moving towards a more satisfactory level will mean finishers will start to see a more encouraging return to the farmgate, which is needed as we approach the autumn season calf sales. However, greater consumer demand is now needed to lift the beef price further, with lack of barbecue weather having impacted on beef sales. Targeted promotions and campaigns towards key events such as the Olympics hope to lift beef sales, but this could then lead to carcass balance issues.

BCMS Data

Despite the continuing declining of suckler cows in Scotland, recent data from British Cattle Movement Service (BCMS) in April 2024 showed a 4.4% increase in female and male beef sired animals aged 12 to 30 months, which contributed to the drop in prime cattle prices throughout the spring.

BCMS data also highlighted an acceleration in the year-on-year reduction of Scotland’s beef breeding herd, with beef sired females aged over 30 months down 2.4% from April 2023.

With figures for England showing a greater decline of 3.2% from the previous year; it looks likely that competition for Scottish bred suckler beef store cattle will continue from buyers south of the border.

With a further decline in Scotland’s beef herd expected this year after a 2.7% fall in calf registrations in 2023; the expectation is that there could be further tightening of store cattle availability in 2025.

Strong Trade for Stores

As demand outstrips supply with fewer cattle of all kinds available; trade for store cattle remains strong.

With several markets reporting store cattle sales averaging £1,400; many farmers will now be sitting down to take a closer look at costs and returns and may consider selling earlier this year, ahead of the usual end of August- early September rush.

MyHerdStats – New Feature

MyHerdStats which is operated by ScotEID, has developed a new stocktake section which can be found by logging into your ScotEID account and selecting MyHerdStats under the cattle menu.

This new feature provides Scottish cattle keepers with a summary of cattle on farm each month within a selected 12-month period. Useful for monthly stock takes and for carbon auditing purposes.

Sarah Balfour, Sarah.balfour@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service