Agribusiness News December 2022 – Sector Focus: Pigs

1 December 2022Record prices but tough times ahead

The pig sector is still very much in the doldrums with increasing costs continuing the long period of negative margins despite pig meat prices now being at record levels. In October, AHDB estimated that the UK pig sector has cumulatively lost £700 million since autumn 2020, when the current crisis began.

Prices have undoubtedly improved during 2022 – the Standard Pigs Price (SPP) has climbed from a low of 137 p.p.kg in February, reaching 200 p.p.kg in September driven by falling supplies at home and in Europe. Since then, however, it has plateaued and the harsh reality is that due to the complex pricing mechanisms in place, producers are receiving prices well below this. Pig meat prices in Europe have also risen considerably in this time, although it is still cheap enough to undercut home-produced pork in UK supermarkets. AHDB revealed that, compared with July 2021 imports had increased by 19% year on year although exports, particularly of offal had also increased.

Backlogs have started to appear on farms again with slaughter weights beginning to creep up over the last two months. Slaughter weights have crept back down to just over 87kg in August, following the rise to 95.8kg in January with pandemic and staffing issues. More recently, however slaughter weights have increased to 90kgs with several issues cited, from lack of demand to plant reliability.

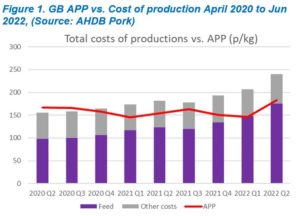

Data from AHDB relating to pig producer margins estimates that producers were losing £52 per pig with prices 58 pence per kg (p.p.kg) below the cost of production in Q2 of 2022 (Figure 1). This represented the seventh consecutive quarter of negative margins. Despite feed costs easing over the early summer, cereal and proteins are firming again, energy prices are jumping, with increases in terms of labour and other costs. Rising interest rates will also now begin to take their toll, especially as overdrafts continue to grow. A recent AHDB estimate suggests that even with much improved prices there is still an average loss of £28 per pig.

While losses are not as bad as earlier in the year, a large hole still remains and cash flows will again be stretched as home grown grains get used up and barley and wheat needs to be bought in. Feed wheat and barley are beginning to rise again though and soya also remains expensive with the events in the Black Sea adding further volatility. Feed is by far the biggest cost for pig producers and figures from AHDB show that feed has gone from 63% to 73% of production costs over the past 2 years. This translates to a rise from £86 per pig to just under £156 per pig in the same period.

Cull sows are now worth between 65 – 70 p.p.kg. and with the EU being the main outlet, the weakening pound has helped support this market despite plenty sows coming forward as herds are dispersed and cut back. Rising feed prices and concerns over future margins means that weaners continue to be a hard sell as specialist finishers remain very cautious.

Census reveals effects of crisis on pigs

The sustained period of losses has inevitably seen a reduction in the UK breeding herd as producers cut back or in many cases leave the sector altogether. DEFRA’s latest census revealed that while pig numbers dropped 4% overall on the year, this was driven largely by a drop in the breeding herd of 18%. With the typical pig production cycle of 5 months, this will result in reduced numbers of finishing pigs before the end of the year, tightening supplies greatly, which may provide the impetus to start prices rising again. One of the dangers of a falling breeding herd is the infrastructure that supports it also shrinks to fit rather than leave capacity for the sector to bounce back. This has been seen in recent weeks with one processor announcing the closure of two plants and a reduction in output of another.

Falling consumer demand has also been blamed for some of the sector’s woes, with AHDB Outlook predicting a 2% fall before the current cost of living crisis. With household budgets stretched, pork may be seen as a cheaper and tasty alternative compared to the more traditional and expensive festive meats, helping arrest the decline in demand. When combined with the expected contraction of supply, it may help kick start some much-needed price rises and offer hope for a happier new year for pig producers.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service