Agribusiness News December 2023 – Cereals

30 November 2023Swing to spring cropping inevitable

The Early Bird Survey results for 2024 cropping have been released by the AHDB. They have been derived from provisional 2023 survey data to produce forecasted crop areas.

The Rises: Although spring barley is anticipated to rise by a significantly 13%, the area of oats is projected to rise by 12% largely due to a greater expected rise in spring sowings. offsetting the fall in winter sown oats. There is also a notable increase in area is expected for arable fallow, up 27% from 2023.

The Falls: Whilst the winter barley area is reported to have fallen by 6%, OSR planting has fallen by 16%, with the harvested area potentially declining further because of waterlogging and heavy rains experienced. Often filling the gap in this situation are pulses, but they too are set to decline, falling approximately 10% from 2023’s harvest.

The UK wheat area for harvest estimate for 2024 is back by 1.3%, all within the winter crop. However, Spring wheat sowings are expected to increase by as much as 23%, albeit from a low base in 2023.

Impact on new crop prices

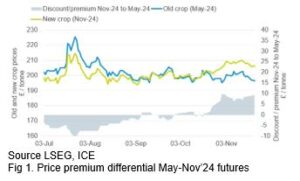

As the markets are aware of a tight supply and demand situation developing for wheat for 2024 Fig 1); wheat currently estimated to be available for export or held as free stock is down 64% on last season at 734,000 tonnes.

Premiums are growing for new crop over old with the differential currently circa at £10-11/ton. The true value of new crop will emerge once a better insight is gained into the viability of the sown crops as they come through the winter.

Barley and oats outlook

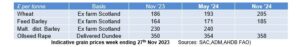

Feed barley prices are being pushed lower, pressured by lack of demand, and although the UK has a sizeable export surplus, it is uncompetitive and therefore trade continues at a slow pace.

Although barley is competitive in domestic feed rations, inclusion rates are already high and with drifting markets, there is little to incentivise a buying rally.

Malting barley of good quality retains its £60-£70 premium over feed as domestic demand remains strong. The outlook for new crop value is less certain given the anticipated increase in area likely to be established in the spring. The indicators for a well- supplied 2024 market are there and locking into risk-free premiums now are worth considering.

Demand for milling oats in the UK remains strong and quality is hard to come by. Merchants are blending and cleaning crops to maximise the supply that could be consumed. Price destruction is a risk later in the season if prices continue to be supported by demand; effectively pricing oats out of the feed market.

Oilseeds & Soya

Global production of oilseeds is expected to continue expanding in 2023/24 reaching a new record high and reflecting higher forecasts for soya and sunflower that more than offset an expected contraction in rapeseed production. The anticipated increase in soybean production primarily hinges on expectations of a considerable output recovery in Argentina and a continued area expansion in Brazil, assuming normal weather conditions in both countries. On the other hand, soybean output in the United States of America will likely decline for the second consecutive season due to reduced plantings.

The UK recent trade figures demonstrate a contracting national rapeseed crop with exports almost half the 5-year average for the quarter July to September. Similarly, over the same quarter, imports have increased year on year by 10% and are 27% greater than the 5-year average.

Mark Bowsher-Gibbs, mark.bowsher-gibbs@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service