Agribusiness News December 2023 – Sector Focus: Pigs

30 November 2023Optimism can be a dangerous thing for the pig sector – just when it looks like there will be much needed sustained period of profitability to help encourage investment, prices start to fall and that feeling of trepidation starts to creep in.

While prices have risen through much of 2023, reaching a peak in mid-August, prices have since fallen back due to weakening domestic demand and a significant drop in EU pig prices. Although producers are still making a profit; feed prices have started to creep up again following the harvest lows for feed barley and wheat. Numbers finished are still well back on previous years due to the contraction of the UK breeding herd over the past two years.

Standard Pig Prices (SPP): From a low of 137 pp/kg in February 2022, the SPP reached a peak of just under 226 pp/kg in August 2023 – a rise of nearly 65% in eighteen months. Since then, a succession of weekly falls has seen the price drop to 217 pp/kg (AHDB). While UK prices have fallen 8.5 pp/kg in recent months, EU producers have seen their prices fall by over 30 pp/kg since July. More interesting and perhaps concerning, is the fact that the differential between UK and EU prices has widened from under 10 pence to 32 pence in recent weeks, much higher than normal, with the EU being the main competitor to UK producers in the home market. Combined with reports showing a reduction consumer demand, the outlook is less positive than a few months ago.

Slaughter Weights: Average slaughter weights have crept up over the summer, breaching 91kg for the first time in over a year although this should reduce in the next few weeks as processors begin to pull forward pigs in the run-up to Christmas. Numbers slaughtered each week continues to be more than 20,000 pigs less than 12 months earlier at just over 150,000 pigs. AHDB have predicted that the reduced throughput in 2023 should result in a reduction in UK pigmeat production of around 15% compared with 2022.

Cull Sows: Cull sow values have crept back over the summer, now being worth 105-114 pp/kg (T.V.C.), which is still much higher than the start of 2022, when prices were a paltry 20 pp/kg – which was a lot of meat for very little money.

Weaners: Weaners continue to be in demand, which specialist finishers still seeing that a reasonable margin can be made. Over the summer, 7kg weaners have traded at £50 – £55/head (T.V.C.) with plenty takers for surplus pigs.

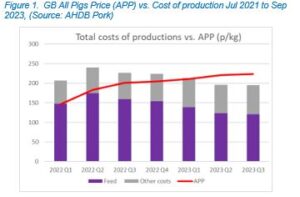

Costs of Production: While prices have eased back from their peak, the latest published margins from AHDB (for Q3 of 2023) showed pig farm margins had continued to increase, albeit only slightly from the previous quarter. Total costs had fallen considerably from the peak of 240 pp/kg (£214 per pig) in Q2 of 2022 to 195 pp/kg (£172 per pig) by Q3 in 2023, with prices received rising to 224 pp/kg (£197 per pig) leaving a margin of 28 pp/kg (£25 per pig). A combination of rising prices and falling costs have contributed to the change in fortunes, with feed prices in falling from a peak of 175 pp/kg (£156 per pig to 121 pp/kg (£106 per pig) in Q3 of 2023.

Imports & Exports and Worldwide

The reduction in finished pigs has inevitably had a knock-on effect in exports with 224kt (worth £0.421bn) exported by the end of September 2023 compared to 284kt (worth £0.452bn) at the same point in 2022. Imports in 2023 to the end of September decreased slightly in volume but showed an increase in overall value being 579kt (value £2.18bn) in 2023 compared to 600kt (worth £1.85bn) by this time in 2022(HMRC).

Further afield, in China, over-supply and weakening demand has seen pig prices fall by over 30% in a year – which is being blamed for potentially putting their economy in a deflationary situation (Reuters).

Sector faces up to life without Zinc Oxide (ZnO)

ZnO has been used at therapeutic levels for many years, playing an important role in reducing post-weaning diarrhoea in young pigs. Following its 2022 withdrawal by the EU, existing supplies are being clawed up. This means that producers are having to review their young pig management with a range of alternatives being tried from nutritional changes, boosting piglet immunity to changes in management.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service