Agribusiness News February 2023 – Input Costs: Feed & Forage Update

2 February 2023Silage analysis update

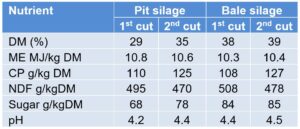

Figure 1 shows the average of all silages received at the SRUC lab between July 22 – Jan 23, of 1st and 2nd cut pit and bale. On average, pit silages have analysed slightly better in energy, however, protein content is very similar between pit and bales. There is a slight up lift in the protein in second cut silages compared to first cuts both in the pit and bales, therefore the ration may need reformulated slightly if changing from 1st cut onto 2nd cut or vice versa. But always make decisions based on your own analysis.

The dry matter is on average slightly higher in 2nd cut pit silages compared to 1st cut and on average very similar between bales. It should be noted there is a huge variation in samples analysed, ranging from 18 – 75% DM. This will affect the quantity of silage animals need to consume to meet their requirements. The average figures of silage DM across pit and bales samples are ideal for a pre-lambing ewe to aid palatability and help meet intake requirements. However, it is essential to have your own forage analysed and balance this with the most appropriate supplement and avoid over or underestimating the contribution from forage.

Figure 1: Pit vs bale silage nutritional content

Feeding costs

In terms of feed costs, prices should be treated as a guide only and are quoted based on full 27-tonne loads delivered, therefore will vary depending on location. At the time of writing (end of January), wheat prices are remaining slightly lower at £254/t; nutritionally, feed wheat is worth around £20/t more than barley. However, in March we may see a lift in prices as domestic surplus stocks are cleared and particularly, if Russia decide to limit their exports.

Feed barley

Feed barley is priced at £228/t and maize around £300/t. The demand for feed barley is slow across Europe, with countries such as Ireland and France opting for maize. A guide price for molasses, 8 tonne delivered load in central Scotland, is pricing around £351 for molasses cane.

Sugar beet pulp

Sugar beet pulp is priced at around £380/t, unfortunately due to heavy frost and an already smaller crop, this has now been left even smaller. This will mean limited availability, reflected in the high prices. Soya hulls are coming in at £75/t cheaper, therefore are still the best value fibre source replacement, however, note lower energy (12ME vs 12.5ME for beet pulp) and they tend to be a more dusty, poorer quality pellet. There is also potential availability could be affected by Argentinian dryness so worth forward planning.

Proteins

Protein prices have been firming on the back of the rise in soya prices. Wheat and maize distillers’ dark grains have limited availability and with the Vivergo plant still not running since before Christmas, this is having an effect on those nearby as they are having to source alternatives. Prices are sitting around £393/t and £378/t respectively.

Soya

Soya is the biggest mover this week with prices being quoted at around £568/t which will have a knock-on effect on the price of high protein concentrates. This could have a big effect on those yet to buy their ewe rolls in the run up to lambing. There is concern this will rise further due to drought conditions in Argentina which has led to a 45-50% yield loss, in addition to at least 0.5M hectares that will not be planted (10% of total acreage). There is currently a £50/t difference between April and May soya, therefore shippers could go very tight in April, coupled with the news in Argentina; this could be a perfect storm. However, worth bearing in mind we did see a similar story last year although the difference being that Brazil are predicting a bumper crop this year, therefore easing supply concerns but not currently reflected in the price.

Rapeseed meal

Rapeseed meal looks reasonable in comparison at around £393/t, although worth bearing in mind if using in a home blend there can be issues with palatability, but this may make protected rapeseed alternatives to soya more appealing. In summary, forward plan your feed budget, contact your suppliers, and sit down with your feed adviser sooner rather than later.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service