Agribusiness News January 2023 – Cereals and Oilseeds

22 December 20222022 world prices remain high

The world saw a 48 Mt fall in the cereal harvest in 2022 due to Russia‘s war on Ukraine and adverse weather in the US and parts of Europe; while Canada, Australia and Russia saw bumper yields. The UK and Scotland saw a good harvest both in quality and high yields despite the hot dry weather which came late enough not to impact yields. Cereal stocks-to-use ratios fell further. According to USDA world grain output fell 47.8 Mt to 2,234 Mt; wheat output +1.2 Mt to 780.6 Mt, coarse grains output -49mt to 1,453 Mt. World grain demand fell 31.5 Mt. World grain stocks fell 16 Mt and stocks to use ratios fell to a 9 year low.

COCERAL estimates the EU+UK 2022 harvested grain crop at 285.5 Mt, down 24.3 Mt from the 309.8 Mt produced in 2021. Oilseed rape output was over 20 Mt, a recent high. In its first forecast for the 2023 cereal crop, a rise of 18.9 Mt to 304.4 Mt is seen.

For the 2022 UK harvest, winter cereal sowings rose, and wheat output lifted 11% to 15.5 Mt. This rise in UK wheat output was enough to move the UK to become a net wheat exporter. This has meant at times UK wheat prices have had to be export competitive but with a tight global situation overall price levels are higher than last year.

UK barley output rose 6% to 7.4 Mt due to high winter barley yields, while spring barley output fell 17% on the back of lower spring barley sowings. Barley’s price discount to wheat in England remained quite low as in 2021 at £15-20/t in 2022.

In Scotland, 2021 cereal output rose to the highest level in 8 years at 3.1 Mt on yields that averaged 1t/ha higher at 7.6t/ha. Wheat output rose 10% and spring barley output rose 17%. Whisky grain demand has risen while the high price of imported maize has led distillers to switch to Scottish wheat. Malting barley premiums of £40/t at harvest were £25-£30/t higher than 2021.

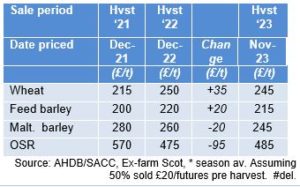

Historic and future grain price summary

2023 – more wheat, less malting barley

With global grain stocks-to-use tightening to their lowest level in 9 years by the end of 2022/23, the market will continue to closely monitor weather around the world. The Russian war on Ukraine shows no sign of ending and the impact on cereal production in Ukraine will only continue to be negative. At least for now grain shipments are continuing from Ukraine’s ports so despite lower production supplies are reaching the world market.

In the UK, the initial AHDB early-bird survey sees 2022 winter cereal sowings higher; wheat +1%, winter barley +4%, oilseed rape + 14%, fallow +9%, but lower spring barley -6% and oats -4%. In Scotland, there was a big swing this autumn to wheat +8% and a fall in winter barley -13% and spring barley -4%. So far, crop condition is good across the UK. High maize prices and strong distilling premiums are encouraging more winter wheat. Spring barley area dropping is a potential issue for the malting and distilling sector if yields and malting quality do not rise as malting capacity has risen substantially in Scotland

Input costs rise: -£ fertiliser and fuel prices remain high, so producers need to achieve high prices to recoup. With world oil reserves at their lowest level in 18 years, and a lack of investment in new production, high oil and energy prices look set to remain. As ever, buy fertiliser + sell grain = to lock in margin.

Global cereal S&D; +£ Output < Demand, Stocks to use falls for 8th year in a row, forward grain prices are not high enough to compensate for high input costs. -£ Economic growth under threat as high energy prices squeeze economies and China still grapples with Covid. The market remains vulnerable to weather conditions.

UK cereal S&D; -£ UK a net wheat and cereal exporter in 2022, likely to continue in 2023 unless yields are poor.

+£/-£ UK 2023 early-bird area estimates – wheat up, spring barley area to decline.

Whisky: Future growth potential for whisky sales linked to world economic growth good but that is weakening.

- Buying today’s inputs especially fertiliser by selling grain today helps cover high costs.

- Malting barley supply in Scotland to be squeezed by rise in winter wheat sowings

julian.bell@sac.co.uk, 07795 302264

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service