Agribusiness News January 2024 – Beef

1 January 2024Summary of 2023 markets

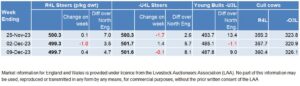

Beef prices in 2023 have like the weather, been volatile. At the start of the year processors increased prices (week ending January 21st, Scottish R4L steers were sitting at 465p/kg/dwt) on the back of the strong retail demand for beef, with prices continuing to trend upwards throughout spring as demand continued to outstrip supply.

Carcase weights fell in the first quarter of the year, a reflection on the dry weather and inflated feed and fertiliser costs. This position then reversed, supporting volumes however recent reports suggest carcase weights are lighter, likely a reflection of wet weather and variable silage quality. The increasing influence of dairy beef bred animals will contribute to lower weights and cattle killing out lighter.

Record breaking prices with store cattle surging past £3/kg and an all-time high beef price of over £5/kg in May led to much needed positively among beef farmers, when many were questioning the profitability of suckler cows. Positivity filtered through to the store ring, with store cattle prices reaching record levels. After a subdued demand in 2022 due to increased feed costs, suckled calves this backend have met a buoyant trade, with many markets reporting sale averages to be well above last year’s levels.

By mid-May prices began on a downwards trajectory, with a 3-month period seeing a price drop of an average of 60p/kg. Prices have since improved and for the last 6 weeks have remained fairly stable sitting around 499pk/kg/dwt for R4L grading steers.

Beef producers, although welcoming the strong beef price this year, have been challenged with increases in input costs and staggering variances in finished beef prices, which for many are unsustainable.

Phenomenal cull cow trade

Cull cow slaughter started in 2023 ahead of 2022 levels, with an increase in demand for mince and a global shortage of manufacturing beef, the cull cow trade reached unprecedented levels. Many markets reported cull cow trade exceeding £2,500/head, at the time making prime cattle look cheap. Cow prices have returned to more normal levels relative to prime cattle prices.

The decline in the Scottish suckler herd remains a concern for the industry. Scotland’s annual census recorded a 3.5% decline year on year in beef cow numbers – with total number of cows sitting at 394,700.

2024 Beef Outlook

Cattle availability looks to remain tight as we go into 2024. ScotEID calf registrations highlight the impact of herd contraction, reporting a significant decline of 2.7% in the first nine months of this year compared to 2022. Looking forward a reduced calf crop in 2023 will put pressure on availability in 2024. However, demand will dictate how much that will impact the beef price.

The much talked about ‘cost of living crisis’ will continue to impact shoppers finances and consumer spending. It is likely in the New Year that demand will be for mince and cheaper cuts, not for prime beef.

Many suckler farmers have taken advantage of the high cull cow prices, culling underperforming cows to improve herd efficiency. An improvement in herd efficiency provides an opportunity to increase rearing percentages, which would in turn help with the reduction in prime cattle availability.

Margins look to remain tight for producers in 2024, with animal protein prices up. Farmers continue to feel the pressure of trying to improve business and herd efficiency along with the challenges of farming in a nature friendly way.

Sarah Balfour, sarah.balfour@sac.co.uk

Scotland prime cattle prices (p/kg dwt) (Source: drawn from AHDB and IAAS data)

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service