Agribusiness News January 2024 – Global Trends

1 January 2024The UK agricultural economy has proved its resilience in the face of significant challenges over the past several years. With luck, the worst of these shocks is behind us, and farmers can look forward to 2024 as a road towards more predictable economic conditions. However, aftershocks continue to ripple across the global economy.

Ukraine

Russia’s ongoing war in Ukraine drove persistently high food price inflation in 2023 and continues to be a major source of uncertainty in future projections as we approach the two-year mark of active conflict. Russia had been a major supplier of agricultural inputs to Europe, and both Russia and Ukraine are significant breadbaskets. The effects on agricultural commodity markets were mitigated by the Black Sea Grain Initiative, which highlights the need for well-functioning and transparent trading systems. Commercial crop producers in Ukraine have seen a 2.3% decrease in cultivated land (266k ha), as well as destruction of equipment, storage facilities, livestock, perennial crops, stolen inputs and output, and unexploded ordinance in fields. Even after a resolution to the conflict, the destruction of infrastructure, loss of lives and displacement of labour will impact production capacity of the region.

State of global markets

The global economy is expected to grow, on average, 2.6% per annum (PA) over the coming decade (2023-2032), while global food consumption is set to expand by 1.3% PA. This is slower than the preceding decade due to a slowdown in population growth (China in particular, where population decreased for the first time in 2022) and an increase in per capita income. The growing risk of weather variability, animal and plant diseases, changing input prices, macro-economic conditions, and other policy uncertainties may lead to different outcomes than those projected here.

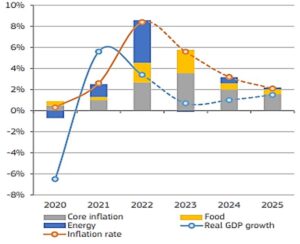

Figure 1: Euro area real GDP growth and inflation forecasts. Source: European Central Bank.

Food price and energy inflation have been the major sources of inflation within the economy as a whole over recent years, however both are expected to decrease in the near term (Fig. 1). At time of writing, current inflation rate sits at 4.6% (the target is 2%).

In Europe, the lasting effects of Covid-19 and ongoing effects of the war in Ukraine include logistical bottlenecks, workforce shortages, and labour mobility challenges. Covid-19 spurred new consumer trends such as increased local sourcing (impacting procurement channels) and greater focus on healthy eating. As a result of food price inflation, consumers are concerned about affordability and are scrutinizing shopping lists.

Input Costs

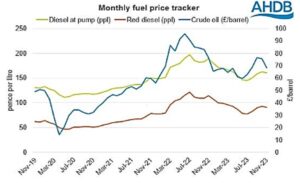

The surge in input prices experienced over the past two years was felt by farmers and consumers around the world and spurred a wave of concern about global food security. Prices for fuel, electricity, and fertiliser (which are linked, as natural gas is linked to all three) have gradually slackened from the 2022 peak (Fig. 2). Those high input prices have driven food price inflation around the world, with the FAO reporting that each 1% increase in fertiliser prices increases the aggregated price of all agricultural commodities by 0.2%, but this varies across agricultural sectors.

Figure 2: Prices for diesel at pump, red diesel, and crude oil, Nov 2019-Nov 2023. Source: AHDB.

After settling back to pre-squeeze levels, energy prices are expected to begin a slow climb over the coming decade. Similar to recent experience, sudden spikes in input costs raise production costs, which drives food price inflation and food insecurity.

Agricultural Sector Spotlights

2023 saw historic price highs for livestock, dairy and cereals, and the year saw concerns around demand, particularly because there was plenty of supply. What goes up must come down; during uncertain times, farmers and producers are encouraged to future-proof themselves as much as possible by minimising overheads, benchmarking against peers, and remaining nimble, keeping an open mind to change and innovation.

Cereals: The global supply of wheat remains constrained due to the extreme weather of the 2022 growing season, as well as lasting effects of the war in Ukraine (see section above). Global wheat prices peaked in May 2022 and have since relaxed somewhat but remain higher than before the spike. A tight supply of maize on the global level is currently providing a strong price floor for all grain types, therefore demand is the larger driver of prices, along with new-crop weather conditions.

Animal feed demand in the UK was projected to fall in 2023, with the lowest cereal usage since 2016/17, due to challenges across monogastric production systems. Demand from the brewing, malting, and distilling (BMD) sector was meant to be strong, however, with the highest human and industrial usage of barley this century. There is increased BMD capacity in Scotland, however 4.5% of licensed premises closed in 2022.

In the coming decade, the increase in global crop production is expected by increased productivity, rather than expanding land use. Investing in raising yields and improved farm management will be essential to enable this.

Oilseeds: Prices for oilseeds achieved record highs at the end of FY 2021/22 but have been drifting down ever since. Farmers expanded the area planted with oilseeds in response to these high prices, with the Scotland 2023 harvest area 36% greater than that of 2019. This large harvest could depress prices in 2023/24, however demand has been strong, especially for crushing, and low supplies in China may also supplement demand and mitigate against low prices.

Dairy: Great Britain was forecast to produce 12.44 billion litres of milk in 2022/23, a slight increase (0.7%) over the previous year. Around the world, milk production was set to grow for the first time after 12 consecutive months of contraction. The UK milk industry has faced headwinds including decreasing farmgate milk prices and labour shortages on top of the larger scale economic conditions of rising interest rates and cost-of-living.

The squeeze on consumer pockets forecasted demand to be weak in 2023. Low prices may attract importing countries, including China, who are expected to increase their import buying since relaxing their zero-tolerance Covid-19 policy. Domestic demand for cheese, butter and yogurt were expected to fall 3% in 2023, and liquid milk sales have been following a steady trend of -1% PA.

Beef: UK beef production was forecast to fall 1.7% in 2023 and the suckler herd is contracting steeply, a decrease of 2.9% over 2021-22 to 1.4 million head. These decreases follow a continuing trend of shrinking margins and low profitability in the beef sector and are exacerbated by consumers looking to cheaper proteins during the cost-of-living crisis and producer uncertainty around what changes to agricultural policy will mean for their businesses, particularly in extensive systems.

Rapid expansion and intensification are expected in the global production of livestock in low- and middle-income countries. This in turn will drive a fast-growing demand for feed, potentially increasing the price of this input, particularly protein crops. Livestock production systems in high-income countries will be sheltered from price spikes through improved feeding efficiencies.

Sheep: 2023 saw an increase in UK lamb production of around 2%, driven by a higher carry-over and a generally stable lamb crop. Consumption this year is expected to weaken in line with other sectors as a result of recessionary pressures. Decreased domestic demand was forecast to have dramatic effects on imports (-20%) and exports (+15%). The balance of trade has changed with New Zealand and Australia, in particular, who are shifting their focus to Asia as a more attractive market. However, new UK free trade agreements with both nations could have negative effects on the price of lamb, if they shift exports back towards the UK.

Pigs: Pork production is 15% behind where it was in 2022, however a gradual recovery is expected in the breeding herd, with numbers projected to have increased by 7,000 head in 2023. The pig sector faces the same challenges as other sectors as retail sales and out-of-home eating declines, expected to depress demand for pork by 3% in 2023.

Climate & Environment

In the coming decade, global agricultural greenhouse gas (GHG) emissions are set to increase by 7.6%. This increase is less than the previous decade and also less than the 12.8% from total agricultural output, indicating a decrease in carbon intensity of agricultural production. However, the urgency of the climate crisis necessitates that farmers take all available actions to lower emissions as far as possible, taking up pioneering solutions and rapidly adapting. The COP28 UAE declaration on sustainable agriculture, resilient food systems, and climate action, which had 158 signatories, highlighted adaptations such as early warning systems as key to reducing vulnerability of farmers to climate change.

Brady Stevens, brady.stevens@sac.co.uk

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service