Agribusiness News March 2023 – Sector Focus: Pigs

28 February 2023Still in the red but light at the end of the tunnel with record prices being received and tight supplies at home and abroad.

The new year has brought new hope to the pig sector with price records being broken on an almost weekly basis. There is some optimism that 2023 will finally see the pig sector turn the corner after two years of sustained heavy losses by producers and the inevitable contraction in the number of farms keeping pigs and breeding sows. With supply getting much tighter, it is hoped that prices continue to rise allowing the beleaguered sector to return to profitability.

Standard Pig Prices (SPP): From a low of 137 p.p.kg in February 2022, as supplies of pigs tighten, the SPP has risen by 50% to just over 206 p.p.kg. While the steady influx of much cheaper product from the EU has kept a lid on prices in the UK, the past few weeks has seen prices rise significantly on the continent with the influential German price now at 2.20 EUR (equivalent to 194 p.p.kg.). This should act as the catalyst for further price rises for UK producers in the weeks and months ahead.

Slaughter Weights: Slaughter weights have remained consistently around 89kg since the start of the year, which is 6kg lighter than 12 months ago when the backlog of pigs on farms was at its height (AHDB). The reduction in sow numbers has fed also through to the number of finished pigs coming through, with 36,000 and 31,000 fewer clean pigs slaughtered than the same week in February 2022 and 2021 respectively in the UK (AHDB).

Cull Sows & Weaners: Cull sows have struggled over the past couple of years due to the effects of BREXIT, the pandemic and plentiful numbers coming forward as herds were reduced or dispersed due to the ongoing pig crisis with cull sows worth only around £0.25/kg last spring – a lot of meat for not much money. Just like the finishing pigs, a corner seems to have been turned, with steady rises through the summer and autumn and the past few weeks has seen further large increases in prices with cull sow values now over £1.10/kg. The more positive outlook has seen more specialist finishers return to the marketplace with 30kg weaners trading at ~ £55/head, although supplies are tight.

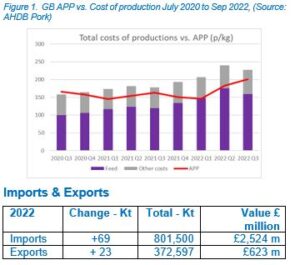

Costs of Production: Despite prices hitting record levels, as can be seen in Figure 1, with production costs estimated to be close to £2.20/kg, the latest published margins from AHDB (for Q3 of 2022) with estimated losses of £0.26/kg or £23 per pig are continuing to take their toll on producer’s bank balances and business viability. Recent price rises have seen the gap close further with some of the most efficient producers close to breaking even.

Despite the UK being a little over 50% self-sufficient in pig meat, imports increased in 2022 although exports also increased particularly of fifth quarter products. News of a free trade deal with South Korea has been welcomed by the pig sector with the National Pig Association (NPA) calling for the UK government to support the development of exports into the country, which has the third highest levels of pork consumption per capita.

Outlook: Based on the contraction of the pig breeding herd due to a combination of poor prices and sow fertility being impacted last summer by hot weather and the subsequent knock-on effects on numbers of finishing pigs, UK pig meat production is expected to reduce by 15% in 2023 according to AHDB’s Pork Outlook. On a more positive note, the same study also expects the breeding herd to recover by 7,000 head by June 2023.

Falling consumer demand has also been blamed for some of the sector’s woes with AHDB Outlook predicting a 2% fall before the current cost of living crisis. In the 12 weeks to 22 January 2023, volumes of pig meat purchased by UK consumers were back 2.8% on the year although total spend increased by 8.1% in the same period (Kantar).

Quality Assurance: QMS has launched new standards for its pig assurance scheme which will be effective from 1st May 2023. Mandatory training for those handling, moving and managing casualties is to be introduced along with enhanced biosecurity and fallen stock containment measures being some of major changes.

Sign up to the FAS newsletter

Receive updates on news, events and publications from Scotland’s Farm Advisory Service